“The report indicates a trade-restrictive trend, which should be a cause for concern. These measures, on both the import and the export sides, contribute to shortages, price volatility, and uncertainty. G20 economies must work to keep markets open and predictable, to enable goods to flow smoothly and foster the certainty that helps incentivize investment and job creation,” said DG Okonjo-Iweala, who will be attending the G20 Leaders’ Summit in Rio de Janeiro, Brazil, on 18-19 November. The Director-General welcomed the trade-facilitating efforts made by G20 economies, noting that they would contribute to easing inflationary pressures.

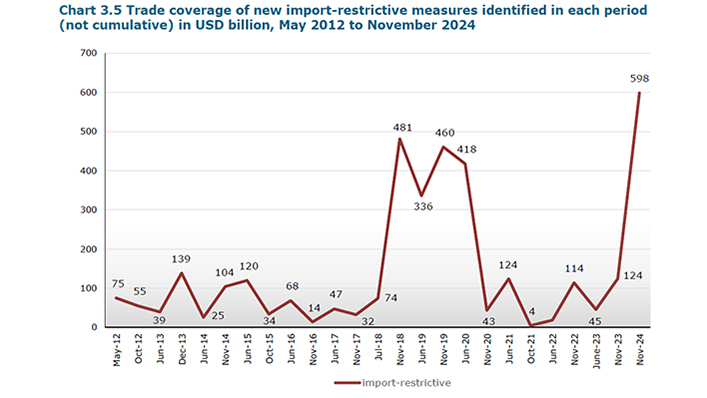

During the review period, which ran from mid-October 2023 to mid-October 2024, G20 economies introduced 91 new trade-restrictive and 141 trade-facilitating measures on goods, both of which mostly dealt with imports. The trade coverage of the trade-restrictive measures was estimated at USD 828.9 billion which was up significantly from USD 246.0 billion in the last G20 report. Similarly, the trade coverage of trade-facilitating measures grew to USD 1,069.6 billion (up from USD 318.8 billion).

The report points to continued growth in the stockpile of G20 import restrictions that have accumulated since 2009. For 2024, the value of trade covered by G20 import restrictions in force was estimated at USD 2,328 billion — 12.7% of total G20 imports or 9.4% of world imports. In the previous report accumulated import restrictions stood at USD 2,287 billion (9.1% of world imports).

Regarding export restrictions, 22 new measures were introduced during the review period covered by the report. In number terms, this is markedly below the annual average of around 50 new measures over the past 3 years, and closer to the pre-pandemic average. However, the trade coverage of these export restrictions has increased substantially.

Export restrictions introduced between mid-October 2023 and mid-October 2024 covered an estimated USD 230.8 billion of merchandise exports, representing 1.3% of the value of G20 merchandise exports or 0.9% of world exports. A year ago, the trade coverage of export restrictions was estimated at USD 121.7 billion (0.7% of G20 exports or 0.5% of world exports).

One positive trend here is that the number of export restrictions on food, feed and fertilizers put in place and not withdrawn since the outbreak of the war in Ukraine decreased to 70, with an estimated trade coverage of USD 11.8 billion (down from USD 29.6 billion a year ago).

The average number of trade remedy initiations by G20 economies was 25.4 per month during the review period, close to the highest peak observed so far in 2020 (28.6 initiations per month). This marks the end of the slowdown observed between 2021 and 2023 in the number of initiations of trade remedy investigations.

In addition, the monthly average of trade remedy terminations recorded for this period was 7.5, the lowest average recorded since 2015. Trade remedy actions, especially anti-dumping measures, continued to be a central trade policy tool for most G20 economies, accounting for 63% of trade measures on goods recorded in the report.

In services trade, G20 economies introduced 50 new measures between mid-October 2023 and mid-October 2024, of which 40% could be considered restrictive. Around 30% of the measures were horizontal measures, impacting mainly mode 3 (commercial presence) and mode 4 (movement of natural persons). A fifth of the new measures referred to Internet- and other network enabled services and telecommunications services.

The review period saw an increase in the introduction of new general and economic support measures by G20 economies, echoing findings by the OECD and the IMF of a rise in industrial policies by governments to support strategic industries and sectors. It is difficult to evaluate the impact of these support measures on international trade and competition. Most of these measures mentioned the environment, energy, and agriculture.

The WTO trade monitoring reports have been prepared by the WTO Secretariat since 2009. G20 members are: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Türkiye, the United Kingdom, the United States, the African Union and the European Union.

Share

Reach us to explore global export and import deals