The Incoterms FOB and CIF are very similar: Both deal with sea and inland waterway transport, and both have similar timelines for the point at which risk and liability pass from buyer to seller. For these reasons, exporters often confuse the two—sometimes to their detriment. In this article, I’ll define CIF and FOB and share the differences between the two, so you can make an informed decision on which term is the best choice for moving your goods.

The Incoterms FOB and CIF are very similar: Both deal with sea and inland waterway transport, and both have similar timelines for the point at which risk and liability pass from buyer to seller. For these reasons, exporters often confuse the two—sometimes to their detriment. In this article, I’ll define CIF and FOB and share the differences between the two, so you can make an informed decision on which term is the best choice for moving your goods.

FOB (Free On Board): A Definition

Free On Board (FOB) means the seller clears the goods for export and delivers them when they are on board the vessel at the named port of shipment. The buyer assumes all risks and costs for goods from this moment forward.

This Incoterm is not commonly used; U.S. companies that choose it often misuse the term because they confuse it with the domestic term FOB.

In addition, this term can only be used when the goods can be delivered directly to the point where they can be loaded upon the vessel. More typically, they will be delivered to a carrier at a container terminal, in which case it would be more appropriate to use the term Free Carrier or FCA.

FOB Responsibilities and Transfer of Risk

Under the Incoterms 2020 rules, FOB means the seller has fulfilled their obligation when the goods are loaded on the vessel nominated by the buyer at the named port of shipment on an agreed upon date or within an agreed upon timeframe. With FOB, the seller is responsible for loading the goods on the transport, while the buyer is responsible for everything else necessary to get the goods to the final destination.

The risk or liability for the goods transfers from the seller to the buyer when the goods are on board the vessel as soon as it is in transit, and the buyer bears costs from that point forward.

CIF (Cost, Insurance and Freight): A Definition

Cost, Insurance and Freight (CIF) means the seller is responsible for loading the properly packaged goods on board the vessel they’ve nominated or “procure goods so delivered.” The seller also bears the cost of freight and insurance to the named port of destination and is required to purchase the minimum level of insurance under Clause C of the Institute Cargo Clauses.

This term can only be used when the goods can be delivered directly to the point where they can be loaded upon the vessel. More typically, they will be delivered to a carrier at a container terminal, in which case it would be more appropriate to use the term Carriage and Insurance Paid To or CIP.

CIF Responsibilities and Transfer of Risk

With CIF, the seller assumes responsibility for the goods from their facilities to the port of destination. Or the seller may procure goods that have already been loaded on a vessel and may be in transit. This type of “string sale”—the multiple sale of goods during transit—is not uncommon for commodities like grains.

The seller is responsible for loading properly packaged goods on board the vessel they’ve nominated and the cost of carriage to the named port of destination on the buyer’s side. The seller must also contract for insurance to at least the port of destination.

The buyer accepts responsibility from the port of destination to their warehouse. It’s important that the sales contract clearly defines at what point at the port of destination this responsibility transfers. Does it include unloading the goods from the vessel?

The risk or liability for the goods transfers from the seller to the buyer once the goods are on board the vessel at the port of shipment.

CIF vs. FOB: The Main Differences

The main difference between Incoterms FOB and CIF is whether the buyer or seller pays for the main carriage of the goods. Under FOB, both the cost and the risk transfer at the point of export. Under CIF, the seller’s responsibility for the goods ends at the port of destination, but their risk for the goods ends when they are loaded on the vessel at the port of export.

With CIF, if the goods are damaged in transit between the port of export and port of destination, the buyer assumes the risk of loss even though the seller contracts with the vessel. However, the seller is required to insure the goods during that portion of the journey.

With FOB, the buyer is responsible for carriage charges; with CIF, the seller is responsible.

FOB vs. CIF: Which Should You Use?

It depends. Although buyers and less experienced exporters may prefer an F-group term, more experienced exporters typically prefer C-group terms. C-group terms like CIF let exporters deal directly with carriers; documentation, bills of lading and all the information needed for letters of credit originate from a single place. Additionally, using C-group terms gives exporters more negotiation power, especially if they book a lot of freight.

However, like all four of the Incoterms 2020 rules designed for sea and inland waterway transport, CIF is best used in situations where sellers have direct access to the vessel for loading, i.e., bulk cargo or non-containerized goods. For most exports, Carriage Paid To (CPT) might be a better choice.

Learn More about Incoterms 2020 Rules

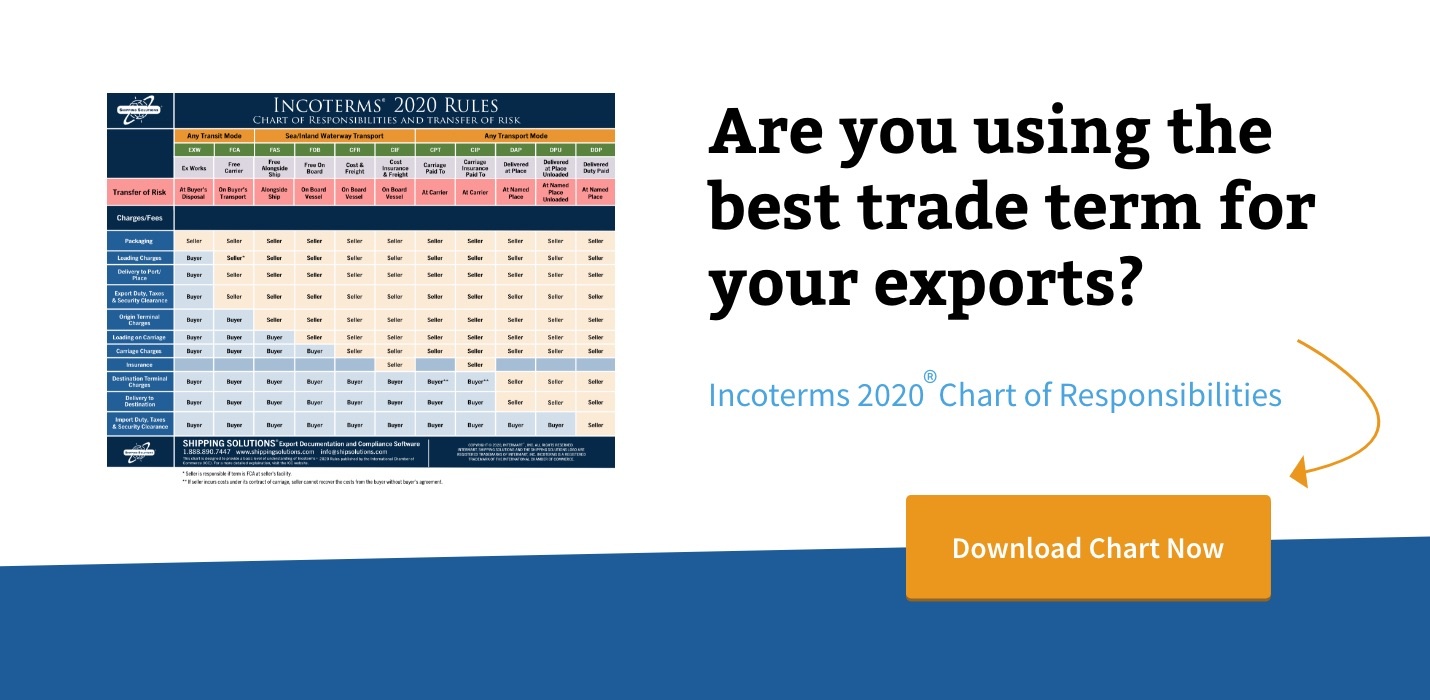

If you are regularly involved in international trade, you need to understand the risks and responsibilities as defined by Incoterms 2020 rules, not just pick the term you always use. Start by getting a copy of ICC’s Incoterms® 2020 Rules book.

For a more detailed understanding of which term or terms make the most sense for your company, register for an Incoterms® 2020 rules seminar or webinar offered by International Business Training. You should also read An Introduction to Incoterms and our articles about each of the Incoterms 2020 rules:

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.