The Incoterms DDP and DAP are very similar: Both deal with all types of transport, and both have similar timelines for the point at which risk and liability pass from seller to buyer. For these reasons, exporters may confuse the two. In this article, I’ll define DDP vs. DAP and share the differences between the two, so you can make an informed decision on which term is the best choice for moving your goods.

The Incoterms DDP and DAP are very similar: Both deal with all types of transport, and both have similar timelines for the point at which risk and liability pass from seller to buyer. For these reasons, exporters may confuse the two. In this article, I’ll define DDP vs. DAP and share the differences between the two, so you can make an informed decision on which term is the best choice for moving your goods.

Delivered Duty Paid (DDP): A Definition

Delivered Duty Paid (DDP) means the seller bears all risk and costs associated with delivering goods to the named place of destination ready for unloading and cleared for import. This Incoterm places the most responsibility and risk on the seller.

DDP Responsibilities and Transfer of Risk

Under the Incoterms 2020 rules, DDP requires the seller to:

- Take responsibility for clearing the goods for export.

- Bear all risks and costs associated with delivering the goods.

- Unload goods at the terminal at the named port or place of destination.

- Clear the goods for import and payment.

- Bring the goods to the place of destination.

With DDP, the seller is also obliged to pay all import duties, the required Value Added Tax (VAT) and other taxes, and execute all customs formalities. This is extremely risky for the seller, because they may not be fully aware of the import clearance procedures in the country of import or how to find a competent local customs broker. The seller must also deal in a foreign currency, which means they are responsible for the currency exchange and its associated risks.

Because of this, the seller may want to use the term Delivered at Place (see below) or Delivered at Place Unloaded (DPU).

With DDP, risk transfers to the buyer at the destination, so the destination should be stated clearly and precisely in all documentation.

DAP (Delivered At Place): A Definition

Delivered At Place (DAP) means the seller is responsible for all charges and risks in transit until the goods reach their destination (at a named place).

DAP is a flexible term ideal for use in multimodal transport: The named destination could be a port, airport, seaport, the buyer’s premise or a border crossing. It does not need to be a freight destination; any named place will work as long as it’s a foreign destination or a border crossing.

DAP may sound similar to CPT (Carriage Paid To), but its flexibility is one of the primary differences. The other difference is that under DAP, the risk of loss stays with the seller until the goods arrive at the named place.

DAP Responsibilities and Transfer of Risk

Under the Incoterms 2020 rules, the buyer is responsible for all costs and risks associated with unloading the goods and clearing customs to import the goods into the named country of destination. The buyer selects a customs broker and is responsible for entry fees, duties, taxes, inspection fees and storage fees if goods are not released in a timely manner. The seller must coordinate with the buyer’s customs broker to provide any documentation required for export clearance.

The seller is not required to unload goods unless specified. However, if the seller’s contract of carriage includes unloading the goods at the place of delivery, they may not recover that cost from the buyer unless agreed upon by the buyer.

With DAP, cost and risk transfers from seller to buyer at the point the goods are available for unloading.

DDP vs. DAP: The Main Differences

The main difference between DDP and DAP is delivery to destination and who is responsible for import duty, taxes and security clearance.

Under DDP, the seller assumes the maximum responsibility in costs and risk from the beginning to the end. Under DAP, the buyer bears the costs and taxes of import clearance.

With DDP, the buyer is responsible for unloading the goods at the final destination.

With both DAP and DDP, the transfer of risk occurs at a named place.

DDP vs. DAP: Which Should You Use?

Because of the complex bureaucracy of import clearance procedures, the level of risk in hiring customs brokers in destination countries, and a potential lack of knowledge around current import duty rates and rate changes, DDP is an extremely risky term for the seller to choose. Exporters should be wary of using it. If you do decide to use DDP, consider this adjustment to mitigate some of the risk that comes with hard-to-estimate taxes: “DDP (named place of destination) excluding VAT or other taxes.”

DDP may also have questionable value to importers, since they must depend on the seller to successfully navigate these challenges.

Using the Incoterm DAP is a preferred choice for the exporter who wants more control over freight but does not want to be involved in import taxes and duties.

Learn More about Incoterms 2020 Rules

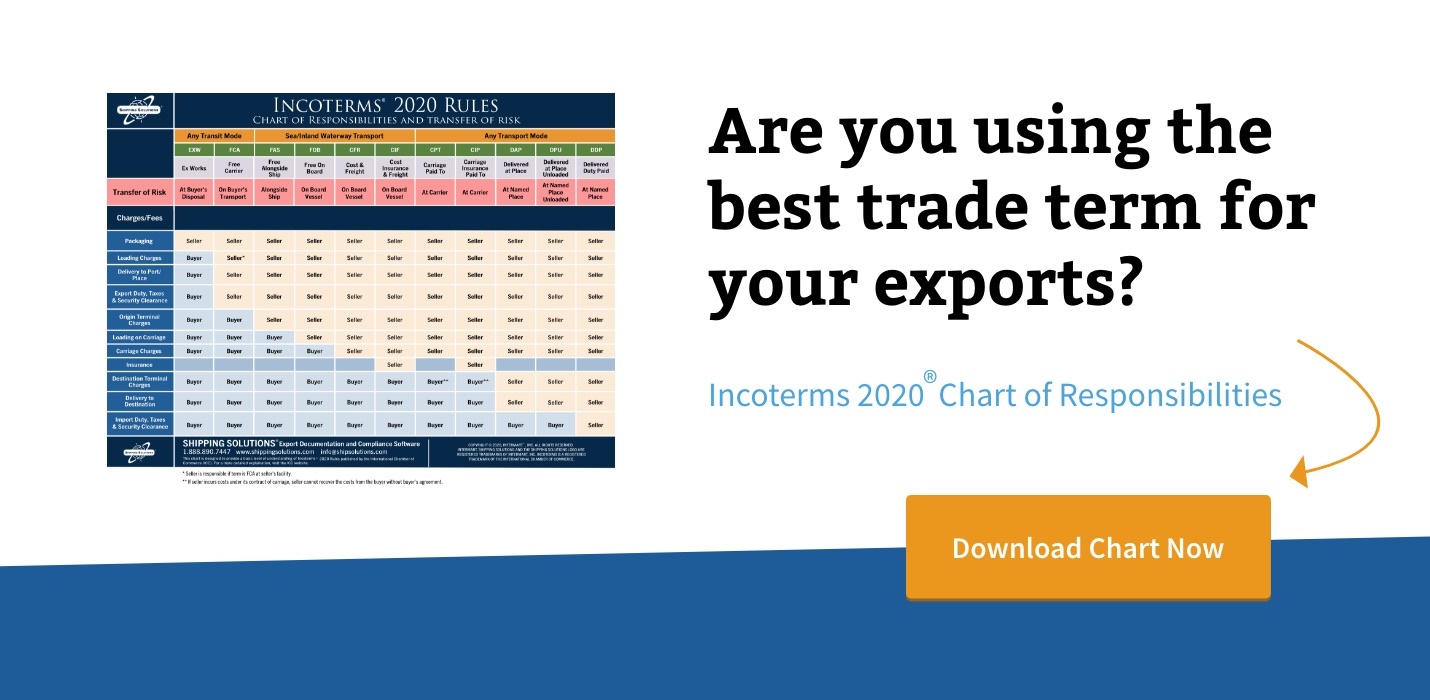

If you are regularly involved in international trade, you need to understand the risks and responsibilities as defined by Incoterms 2020 rules, not just pick the term you always use. Start by getting a copy of ICC’s Incoterms® 2020 Rules book.

For a more detailed understanding of which term or terms make the most sense for your company, register for an Incoterms® 2020 rules seminar or webinar offered by International Business Training. You can also read our articles about each of the Incoterms 2020 rules here:

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.