In the fall of 2000, the U. S. Census Bureau updated the Foreign Trade Regulations (FTR) and replaced the term Exporter with the term U.S. Principal Party in Interest or USPPI.

In the fall of 2000, the U. S. Census Bureau updated the Foreign Trade Regulations (FTR) and replaced the term Exporter with the term U.S. Principal Party in Interest or USPPI.

Even though this change was made nearly two decades ago, some companies are still confused by this change especially when it comes to their responsibilities, even if they are only shipping the goods to a domestic location.

In this blog post, I’ll try to clarify the responsibilities of a USPPI and use a series of case studies to identify the exporter and USPPI in each of the scenarios.

The Foreign Trade Regulations Changes

There are several reasons the Census Bureau changed the FTR regulations including:

- To clarify and specify the documentation and documentation sharing responsibilities of all parties in an export transaction.

In a routed export transaction, the forwarding agent is responsible for providing the USPPI with documentation verifying that the information provided by the USPPI was accurately reported through the Automated Export System (AES) on the Automated Commercial Environment (ACE) platform.

- To identify the data the USPPI is responsible for reporting, which is their name, Employer’s Identification Number (EIN) and basic commodity information to the U.S. agent of the Foreign Principal Party in Interest (FPPI) in a routed export transaction.

- To create conformity in document issuance. For purposes of providing the electronic export information (EEI) that is submitted to AES, the exporter is always designated as the USPPI, and the FTR clearly specifies who that party must be.

The Export Administration Regulations (EAR) define the parties who may be listed as applicant on the Bureau of Industry and Security (BIS) license. The only difference is that the EAR, in certain routed export transactions, will allow the agent of the foreign principal party in interest to be listed as the exporter on the license.

This has caused consternation and confusion among many companies that are shipping their merchandise to foreign customers as they try to understand the regulations and determine who is legally defined as the USPPI for their shipments.

The U.S. Census Bureau website provides these definitions of the USPPI:

Who Is the U.S. Principal Party in Interest?

The person in the United States that receives the primary benefits, monetary or otherwise, of the export transaction; generally that person is the U.S. seller, manufacturer, order party or foreign entity. The foreign entity must be listed as the USPPI if it is in the United States when the items are purchased or obtained for export.

Who Cannot Be the U.S. Principal Party in Interest?

The forwarding agent or the consolidator cannot be listed as the U.S. principal party in interest on the AES record except for one very specific exception. A freight forwarder who acted as a customs broker and arranged import clearance of goods can be listed as the USPPI if the goods are subsequently exported without change or enhancement.

Who Can Be the U.S. Principal Party in Interest?

Generally that person can be the:

- U.S. seller (wholesaler/distributor) of the merchandise for export.

- U.S. manufacturer if selling the merchandise for export.

- U.S. order party if the order party directly negotiated between the U.S. seller and foreign buyer and received the order for the export of the merchandise.

- Foreign entity if in the U.S. when items are purchased or obtained for export.

Case Study #1

This first case study is a common export transaction, and it is relatively easy to determine who is the USPPI. The next two case studies will demonstrate how complex it can be to determine the USPPI.

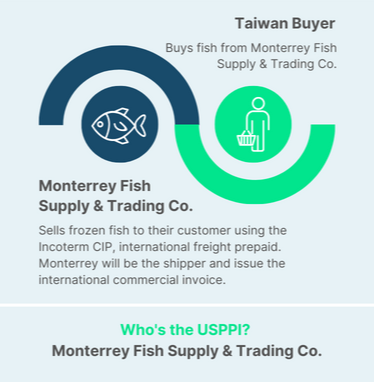

Seller: Monterrey Fish Supply & Trading Co., 14555 Monterrey Bay Road, Monterrey, CA 98888

Monterrey Fish Supply & Trading Co. sold 30 Metric Tons of frozen fish to their customer in Taiwan using the Incoterm CIP Kaohsiung, Taiwan, international freight prepaid. Monterrey will be the shipper on the international bill of lading and they will issue the international commercial invoice.

USPPI in this transaction: Monterrey Fish Supply & Trading Co.

Exporter in this transaction: Monterrey Fish Supply & Trading Co.

Responsibilities of Parties in an Export Transaction

Even if your company doesn’t sell directly to any international customers, you may have domestic clients who do turn around and export your goods. If you know that your product(s) will eventually be shipped internationally—or even if you just suspect that they might—you have certain responsibilities.

First, you may have a discussion with your domestic customer’s freight forwarder about who is the USPPI in a transaction. In the case study below, while the supplier is part of the international transaction, they are not the USPPI and will not be included in the EEI submitted to AES.

Second, even if you are not the USPPI, you can be held legally liable if your goods wind up in a country or in the hands of a company or individual that the U.S. government has banned from conducting business with a U.S. company. To protect your interests, you should check the list of denied parties—also known as restricted parties—with whom you cannot conduct business either directly or indirectly.

For more information about your export compliance responsibilities, including restricted party screening, download the free white paper What You Need to Know About Export Compliance.

Case Study #2

Seller: Monterrey Fish Supply & Trading Co., 14555 Monterrey Bay Road, Monterrey, CA 98888

Supplier: John’s Fishing Co., Rural Route 5, Brainerd, MN 55555

John’s Fishing Co. sold 30 metric tons of frozen fish to Monterrey Fish Supply & Trading Co. using the Incoterm ExW Brainerd, MN. Monterrey Fish arranged with the ocean carrier to delivery an empty 40-foot refrigerated container to John’s warehouse in Minnesota. All transportation charges were collect for the account of Monterrey.

Monterrey will be the shipper on the international ocean bill of lading and they will issue the international commercial invoice.

USPPI in this transaction: Monterrey Fish Supply & Trading Co. Monterrey Fish Supply & Trading Co. will be the USPPI and the exporter, because Monterrey Fish Supply made the international sale and is getting the most benefit from the sale.

Exporter in this transaction: Monterrey Fish Supply & Trading Co. Monterrey Fish Supply & Trading Co. will be the exporter because it arranged and paid for all the transportation with the ocean carrier; it is in control of the export.

Although John’s Fishing Co. is not included in the electronic export information submitted to AES, they are a party to this international transaction.

Routed Export Transaction

If you’re like countless other exporters, there’s a good possibility you export using the international trade term Ex Works (EXW) as described in Incoterms 2020. (See why using the term Ex Works could put your company at risk.) Under this term, you and the buyer have agreed to a trade term where the buyer (usually the FPPI) selects the freight forwarder. As I mentioned above, this is called a routed export transaction.

Case Study #3

The following case study illustrates just such a situation:

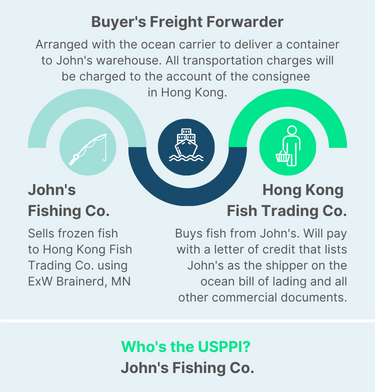

Seller: John’s Fishing Co., Rural Route 5, Brainerd, MN 55555

John’s Fishing Co. sold 30 metric tons of frozen fish to Hong Kong Fish Trading Co. ExW Brainerd, MN. The buyer’s freight forwarder arranged with the ocean carrier to deliver an empty 40-foot refrigerated container to John’s warehouse in Minnesota. All transportation charges will be charged to the account of the consignee in Hong Kong.

John’s Fishing will be paid under a letter of credit requiring that their company’s name appear as the shipper on the international ocean bill of lading and all other commercial documents.

USPPI and the Exporter in this transaction: John’s Fishing Co.

John’s Fishing Co. will be the USPPI and the exporter because John’s Fishing Co. made the international sale and is getting the most benefit from the sale.

USPPI Data Requirements

In a routed export transaction, the FPPI must grant authority for filing the EEI through AESDirect to someone located in the United States, typically either the USPPI or the freight forwarder. If the USPPI is not the party granted authority to file through AES, they are required by the FTR to provide 12 pieces of information to the freight forwarder in this transaction for for filing through AES. They are:

- Name and address of the U.S. principal party in interest

- U.S. principal party in interest’s EIN (Employer Identification Number)

- State of origin

- Foreign Trade Zone (FTZ), if applicable

- Commercial description of commodities

- Origin of goods indicator: Domestic (D) or Foreign (F)

- Schedule B number or HTSUS code

- Quantities and units of measure

- Value

- Export Control Classification Number (ECCN) or sufficient technical information to determine the ECCN

- All licensing information necessary to file the EEI for commodities

- Any information that it knows will affect the determination of export license authority

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This post was originally published in 2001-2002 in three parts and has been updated to include current information, links and formatting and combined into a single article.