Securing payment for your international exports is arguably the sweetest reward—the culmination of your tireless efforts in navigating new foreign markets. But this hard-earned victory can unravel if the payment mechanism isn’t airtight. Bank drafts add a layer of trust and protection to the international payment process, especially when dealing with unfamiliar clients or navigating tricky regions.

Securing payment for your international exports is arguably the sweetest reward—the culmination of your tireless efforts in navigating new foreign markets. But this hard-earned victory can unravel if the payment mechanism isn’t airtight. Bank drafts add a layer of trust and protection to the international payment process, especially when dealing with unfamiliar clients or navigating tricky regions.

They’re often used along with letters of credit or documentary collections, two of the five primary methods of payment in international trade. In this article, I’ll explain the role bank drafts play in securing payments for international exports, the process of issuance, their use in conjunction with letters of credit and documentary collections, and how to accurately fill out a bank draft.

What Is a Bank Draft?

In the context of international trade, a bank draft is a financial instrument used as a method of payment. Also known as a banker’s draft or a cashier’s order, a bank draft is essentially a check drawn by a bank on its own funds. It serves as a guarantee of payment to the recipient (typically the exporter) by the issuing bank.

Here’s how the process of using a bank draft typically works:

Request for Payment

The exporter and importer agree to use a bank draft as the method of payment for the international transaction.

Issuing the Bank Draft

The exporter’s bank (issuing bank) creates a bank draft, which is a written order to pay a specific amount to the exporter.

Details on the Bank Draft

The bank draft includes crucial information such as the beneficiary’s name (the exporter), the amount to be paid, the currency and any terms or conditions specified in the sales contract. (I explain more specifics about filling out a bank draft below.)

Delivery to Importer

The bank draft is then delivered to the importer or the importer’s bank. Usually, the seller’s bank will send the bank draft and related documents via the freight forwarder to the buyer’s bank or a bank with which it has a relationship in the buyer’s country.

Payment Guarantee

Upon acceptance of the bank draft, the issuing bank guarantees payment to the exporter. This provides a level of security for the exporter, especially in cases where there might be concerns about the creditworthiness of the importer.

Processing at Receiving Bank

The importer or the importer’s bank presents the bank draft to the paying bank (drawee bank) for payment.

Payment and Settlement

When the buyer authorizes payment for the goods, the buyer’s bank releases any documents to the buyer and transfers the funds to the seller’s bank.

Using a bank draft in international transactions is particularly common when dealing with unknown parties or regions where trust might be a concern. It provides a level of assurance to the exporter that payment will be made, as the bank is obligated to honor the draft.

Using a Bank Draft with Letters of Credit and Documentary Collections

To protect the interests of both the buyer and seller in an international transaction, the parties may agree to use a letter of credit or documentary collection. These two payment methods require that payment be made by the buyer to the seller upon presentation of a bank draft.

Here’s how a bank draft may be used in each of these transactions:

Letter of Credit (L/C)

In a letter of credit arrangement, the importer’s bank issues a letter of credit to the exporter, guaranteeing payment upon the presentation of specified documents and compliance with the terms and conditions of the credit.

The letter of credit may specify the use of a bank draft as the method of payment. The exporter is required to draft a document that instructs the paying bank to make payment to the exporter or a nominated party. This bank draft is then presented along with other required documents to the bank specified in the letter of credit.

Read more about using a letter of credit in our article, Methods of Payment in International Trade: Letters of Credit.

Documentary Collections

Documentary collections involve the exporter shipping the goods and presenting the shipping documents to their bank. The exporter’s bank forwards these documents to the importer’s bank with instructions for payment.

Similar to a letter of credit, the exporter may use a bank draft as part of the documentary collection process. The bank draft becomes a payment order, instructing the importer or the importer’s bank to make payment to the exporter upon fulfillment of certain conditions. The bank draft may or may not include a transmittal letter, which includes details of the draft transaction including the types of additional documents that are included and payment instructions.

Read more about using documentary collections in our article, Methods of Payment in International Trade: Documentary Collections.

Payment Guarantee

In both scenarios, whether through a letter of credit or documentary collections, the use of a bank draft provides a level of assurance to the exporter. The bank draft serves as a payment guarantee, backed by the issuing bank’s commitment to honor the draft upon compliance with the specified terms and conditions.

How to Fill Out a Bank Draft

Accuracy in filling out the bank draft is crucial in both cases. Any discrepancies or errors can lead to delays in payment or even non-payment. If using a letter of credit or documentary collection, the exporter needs to ensure that the bank draft aligns with any stipulated requirements.

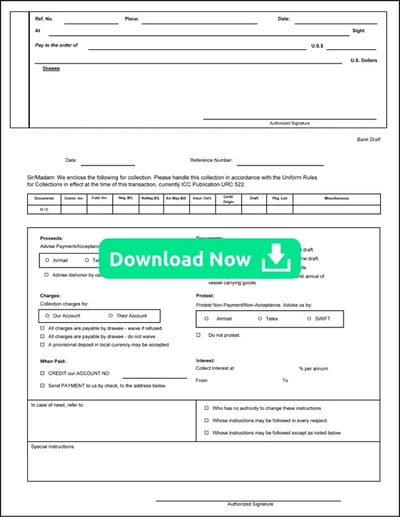

Download a free PDF of a bank draft here, and ensure the following information is included:

Exporter and Importer Details

Clearly state the full names, addresses and contact information of both the exporter and the importer.

Clearly state the full names, addresses and contact information of both the exporter and the importer.

Goods Description

Thoroughly describe the exported goods, including quantity, weight and any relevant specifications. Ensure precision to avoid discrepancies during customs clearance.

Incoterms and Shipment Details

Specify the chosen Incoterm to outline the responsibilities of both parties. Clearly indicate the shipment date, method of transportation and destination port.

Payment Terms and Currency

Clearly define the payment terms, indicating when the draft needs to be paid, whether on sight (immediately) or at a predetermined date. Specify the currency for the transaction to avoid misunderstandings.

Documentary Requirements

Align with the required documentation for the letter of credit or documentary collection. Ensure all supporting documents, such as the bill of lading and commercial invoice, are accurately included.

The Easier Way to Create a Bank Draft

Getting the information on your bank draft right is crucial to the smooth processing of payment.

Shipping Solutions export documentation and compliance software makes it easy to create more than two dozen standard export forms, including a bank draft with or without a transmittal letter. With Shipping Solutions, you don’t need to keep entering the same information over and over again on the various forms. Instead, you can enter the contact, product and shipment information just once, and the software puts the right information on the right export forms in the right format, allowing you to create those documents up to five times faster than you do now. Click here to schedule a free demo of the software.

Like what you read? Join thousands of exporters and importers and subscribe to the International Trade Blog to get the latest news and tips delivered to your inbox.