Exporting goods can be a great way to grow your business, but it can also be a complicated process, especially when it comes to documentation requirements and changing regulations abroad. You need to know what forms are required before you ship your goods to avoid delays and extra fees, but finding this information is often easier said than done.

Exporting goods can be a great way to grow your business, but it can also be a complicated process, especially when it comes to documentation requirements and changing regulations abroad. You need to know what forms are required before you ship your goods to avoid delays and extra fees, but finding this information is often easier said than done.

You should start with an understanding of the most-common documents required for every export transaction. (Learn about them in our article 11 Documents Required for Exporting.) Where things can get a little more complicated is when exporters start hearing about changing import regulations abroad.

We’ve heard from many Passages readers over the years with stories like these:

I was told by a customer that a new law is being enacted in “X” country. When I try to search for these new requirements, I have no luck. Others have heard the same from a destination country’s government, but the exporter can find no mention of a new law on the country’s trade administration website. In fact, no supporting information can be found anywhere.

How should these exporters proceed? Unfortunately, there is not any one resource you can turn to for this information. Instead, it requires a combination of strategies to determine the best path forward.

1. Talk With Your Buyer

You should have a conversation with the buyer/importer early in the sales process to try to identify all the documents required for the shipment and who is responsible for filling them out. It’s better to know this information before it’s time to ship. Your buyer should be a good resource when it comes to knowing what documents are needed to clear customs in the country of import.

2. Talk With Your Freight Forwarder and/or Foreign Customs Broker

Hopefully, you’re working with partners who have experience shipping goods to the buyer’s country and can help you determine what documents may be required. Even if the destination for your shipment is new to your forwarder, they likely have good resources for learning about the new destination’s requirements and a network of colleagues they can turn to for advice, even if they don’t have first-hand experience.

In the article Freight Forwarder vs. Customs Broker: What’s the Difference? you’ll learn more about how forwarders and brokers fit in the international shipping process.

3. Run an Import Controls Screening

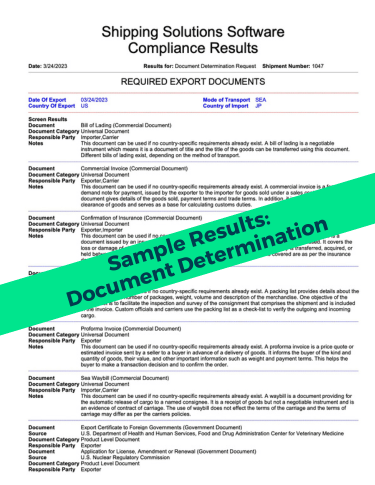

Shipping Solutions Professional’s Document Determination Wizard provides an outline of the type of documents usually required for an international transaction, including the required export documents, transportation documents and import documents. It also identifies potential documentation requirements based on the Schedule B or HTS code of the items in the shipment. Click here (or the inset image) to see a sample set of results after using the Document Determination Wizard. If you want to learn more about how the software works, we’d love to give you a free demo.

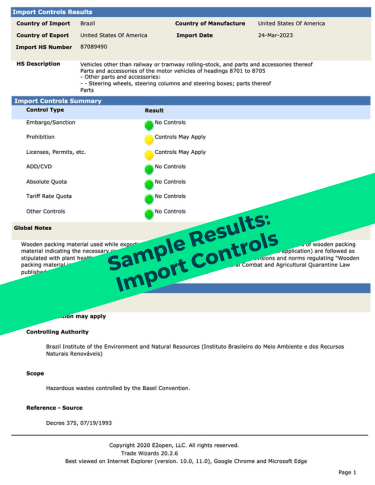

The Shipping Solutions Import Controls Wizard will also help. It identifies any import restrictions that may apply to your export, including any embargoes or sanctions, import license or permit requirements, general prohibitions, quotas or other controls based on the classification of your products. Here is a sample screening from the Import Controls Wizard. The other Shipping Solutions Trade Wizards include product classification, restricted party screening,  export license determination and a landed cost calculator. Try them all for free here.

export license determination and a landed cost calculator. Try them all for free here.

4. Government Resources

If you get pushback from your importer, their broker or the foreign country’s customs authority, reach out to the U.S. Commercial Service office near you. They have personnel in many countries of the world who can help navigate import barriers put in place to make it difficult to export goods there. You can learn more about this in the Passages article Tapping Into the U.S. Commerce Service’s In-Country Offices.

The International Trade Administration’s website has some general information about foreign import regulations here.

5. Consider a Different Incoterm for Your Transaction

Incoterms define the responsibilities of buyers and sellers in international transactions, and they have an impact on who is responsible for completing the required export documentation.

If you find exporting to a particular country difficult, you may want to analyze the Incoterms you use for that particular export transaction.

The Incoterms Ex Works (EXW) and Free Carrier (FCA) put most of the responsibility for documentation and import clearance on the buyer or the buyer’s representative. There are other terms that require the importer to prepare the documents required for customs clearance. You can read about each of the terms in our article An Introduction to Incoterms, which includes links to more in-depth articles about each term. You’ll also want to download the Incoterms Chart of Responsibilities.

In Conclusion

Staying up to date with import regulations abroad can be a challenge for exporters. Using these strategies, you’ll navigate changes without too many bumps in the road. Reach out and let us know if there are any other strategies that have worked for you.