If your company exports goods valued at more than $2,500 to anywhere other than Canada or exports goods that require an export license, U.S. Foreign Trade Regulations (FTR) require that you file your export information electronically through the Automated Export System (AES).

If your company exports goods valued at more than $2,500 to anywhere other than Canada or exports goods that require an export license, U.S. Foreign Trade Regulations (FTR) require that you file your export information electronically through the Automated Export System (AES).

The Census Bureau uses this information to calculate export statistics and shares it with U.S. Customs and Border Protection (CBP) to ensure compliance with U.S. export regulations.

Reporting Your Export Information

If you’re old enough, you probably remember the days when exporters included a Shipper’s Export Declaration (SED) printed on goldenrod paper along with the rest of the paperwork for their export shipment, but changes to the FTR eliminated this option. In addition, the revised regulations increased the civil and criminal penalties for failing to file through AES or for filing incorrect information up to a maximum of $10,000 per violation—a 10-fold increase over previous penalties.

The new regulation also granted the Office of Export Enforcement and CBP the ability to investigate and enforce these rules.

In this article, we’ll look at all aspects of filing your electronic export information (EEI) through AESDirect. We’ll also provide resources that can help you do this in compliance with the regs, successfully and confidently.

When to File through AES

An AES filing is required for most exports of merchandise valued at $2,500 or more by Schedule B number from the United States to a foreign country from one hour up to 24 hours prior to the actual export, depending on the method of transportation. The AES filing is also required for all exports that require an export license from the U.S. Commerce or State departments or exports of used vehicles, regardless of value. Exports of any value from the U.S. to Canada don’t require an AES filing unless the goods require an export license or license exception, or they are a used vehicle.

When required, an AES filing can be submitted by the U.S. Principal Party in Interest (USPPI), which is typically the U.S. exporter; an authorized agent of the USPPI; or, when the buyer hires a U.S.-based freight forwarder to arrange the export, an authorized U.S. agent of the Foreign Principal Party in Interest (FPPI), which is typically the ultimate consignee. If the export company or the foreign buyer plans to rely on an agent or freight forwarder to file a submission through AES, they must present this agent with a written limited power of attorney or some other written authorization.

According to the Census Bureau, electronic filing of the EEI through AESDirect improves the government’s ability to monitor and prevent exports of critical goods and technologies that may threaten our national security; it also significantly improves the quality and timeliness of export statistics.

When an exporter utilizes AES via export documentation software such as Shipping Solutions, the company can eliminate redundant data entry, reducing mistakes, and experience substantial cost savings. Some Shipping Solutions customers have recouped their investment in the software in less than 10 export shipments.

In addition, by utilizing an AESDirect-certified software program, export companies eliminate the need to create their own electronic data interface (EDI). It also allows them to keep the AES filing in-house, since the exporter is responsible for the accuracy of the data, regardless of who files. (See the blog post Why I Hate Routed Export Transactions.)

Registering for AESDirect

Since early 2016, exporters or their agents having been submitting their EEI filings through AESDirect located on the CBP’s Automated Commercial Environment (ACE). If your company imports, it may already have an ACE account. In that case, your account administrator can add the exporter role to the account.

If you aren’t an importer or don’t already have an ACE account, you can apply for an ACE account using the ACE Exporter Account application. The application is simple and will only take a few minutes to complete. An ACE account allows for multiple EINs to be managed under a main account, so be sure to create the main account first and then add additional EINs to the main account.

Once you have set up your AESDirect account, you can submit your filings by typing your electronic export information directly on the AESDirect screens on the ACE portal, or you can submit your EEI without having to retype all this information by using an export documentation software like Shipping Solutions.

The Advantages of Using Software to File through AES

If your company does very little exporting or if you are satisfied to manually create your export documents and perform your compliance screening responsibilities, it probably makes sense for you to file your electronic export information through AESDirect by entering the information manually on the ACE platform.

If, however, you are looking for a way to file through AES while also reducing the time it takes to complete your export forms and compliance screenings, Shipping Solutions export software makes a lot of sense for your company.

Shipping Solutions eliminates redundant data entry, which means the information you enter to prepare a commercial invoice or a bill of lading will also be used for your AES filing. Shipping Solutions allows you to create more than two dozen standard export forms, in addition to filing your export information through AES.

Shipping Solutions Professional also lets you use this same information to check the Export Administration Regulations (EAR) and the various government Denied Parties lists to determine if you need to apply for an export license before you can ship your goods, and to make sure you aren’t doing business with anyone or any organization you shouldn’t.

Changes to U.S. export regulations have increased penalties for export violations to more than $300,000 per violation, and could also include bans on exporting and even jail time. For more information about EAR export regulations and an outline of potential export penalties, check out the Bureau of Industry and Security (BIS) publication Don’t Let This Happen to You.

Preparing a Shipment for AES

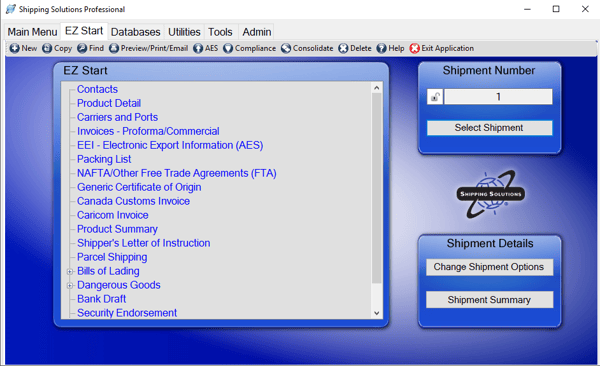

Shipping Solutions makes filling out your export documents and filing through AES fast and easy. Shipping Solutions’ EZ Start Tab allows you to enter the information you need for AES and your export forms, and then the software automatically completes the documents and prepares the data for AES.

To make the program easy to use, the EZ Start Tab is divided into a number of different screens, each focusing on either certain types of information (e.g., contacts and product-detail information) or on specific forms (invoices, electronic export information for AES, packing list, and more). By working your way down the list—skipping those screens or fields you don’t need for a particular shipment—you will complete a set of export documents.

Shipping Solutions Professional’s EZ Start Screen

As a general rule, Shipping Solutions recommends that all users check and complete the pertinent fields on the first five screens: Contacts, Product Detail, Carriers and Ports, Invoices, and EEI. These screens either include information that is required on most of the forms or they represent the basic forms required for exporting, i.e. the invoices and the export information you are required to file through AES.

As you enter the appropriate information in each of the EZ Start’s various screens, Shipping Solutions automatically enters the information in the proper fields on the appropriate forms. So while the exporter information appears on most of the export forms, you only have to enter the information once.

(For a more detailed explanation of how to use Shipping Solutions to prepare all your export documents and perform compliance screening, view this short video: Getting Started with Shipping Solutions.)

To prepare a shipment record for an AES filing, you will need to complete the appropriate fields on the Contacts, Product Detail, Carriers and Ports, and EEI screens. You may not need to enter information into all the data fields available on each of the screens (for example, you don’t need to enter the Free Trade Agreement (FTA) information on the Product Detail screen if you aren’t preparing an FTA Certificate of Origin, like the one for the USMCA), but at least some of the data fields will be required.

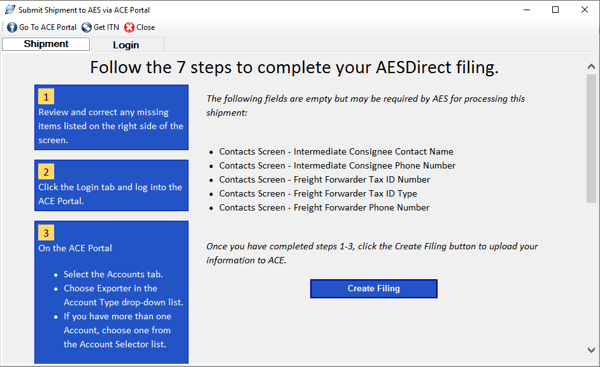

Once you have finished entering your shipping information into the various EZ Start screens, you click on the AES button located on the toolbar at the top of the screen. A new window titled, “Follow the 7 steps to complete your AESDirect filing” will open with instructions for completing your filing.

Submitting Your AES Information via Shipping Solutions Export Software

Step 1 is to review your export information before you submit it to AES to ensure you’ve entered all the required data fields. If not, Shipping Solutions will tell you what fields you are missing and where to go to enter the missing information. Once all the required data is entered, the software will tell you that you aren’t missing any information.

At that point, follow the remaining six steps outlined on this screen. Once your data has been successfully submitted and AESDirect has accepted your filing, you will see your internal transaction number (ITN); it serves as proof that you successfully filed your export information. You must include the ITN reference number on certain export documents to notify your freight forwarder, shipping company and U.S. Customs and Border Protection that you filed your export information electronically through AES.

Shipping Solutions provides a field called the AES ITN Code or Exemption Statement on the EEI screen where you can enter or paste the ITN Reference Number so it will appear in the appropriate spots on the appropriate forms. You will also need this number to access your AES filing record if you need to make any changes to it after it has been submitted.

That’s all that is required to use Shipping Solutions to file your export shipments through AES. Depending on how many product line items you have in a particular shipment, it can take as little as five to 10 minutes to prepare a shipment record for AES. At the same time you’ve also entered much of the information required to create invoices, certificates of origin, bills of lading and a packing list.

You can save even more time creating your export documents and filing through AES by using the Data Exchange Manager available in the Shipping Solutions Professional version. This utility allows you to import orders from your company’s accounting, order-entry or ERP system and typically eliminates 50% to 75% of manual data entry.

AES Resources

Check out these additional resources for learning more about filing your electronic export information through the Automated Export system:

1. AES Webinar

In the one-hour webinar Filing Your Electronic Export Information through AESDirect, experts Robert Imbriani and Lisa Nemer show you when and how to do your AES filings.

2. AES Whitepaper

Download the popular whitepaper Filing Your Export Shipments through the Automated Export System (AES). In 37 pages, it covers what AES is, how to get an account with ACE, and when and how to file. It also defines every data element required by AES. It’s a very useful resource for both the seasoned AES filer and the newbie.

3. AES Tutorial Video

We’ve produced a short video (less than seven minutes), Filing Your EEI through AESDirect via the ACE Portal, that tells you what information you need to file through AES, and shows you step-by-step how to file that information through AESDirect using Shipping Solutions export software, from logging in to resolving errors.

4. Who to Call for Help

If the webinar, whitepaper, videos and blog posts don’t answer your questions, here are some other helpful resources:

- If you are a Shipping Solutions user, give us a call at (651) 905-1727 with any questions you have about filing with AESDirect using Shipping Solutions.

- For questions about your ACE account, call the ACE Account Service Desk at (866) 530-4172, option 1.

- General questions about EEI filings can be directed to the U.S. Census Bureau’s Data Collection Branch at (800) 549-0595, option 1.

5. Other AES-Related Information

- Reports: Even if your forwarder files your Electronic Export Information (EEI) for you, you can now run reports in ACE to make sure they are doing it—and doing it right. The reports are also helpful if you file yourself. Find out how with this blog post: Discover AESDirect Reports on ACE.

- Statements: We all tend to click “I agree” on a new software program without ever reading what we’ve agreed to, because if you want to use the program, you have to agree! But the AESDirect “I agree” screen actually has some good, basic information, such as when you have to file and a link to the Foreign Trade Regulations. Since you can never see them again once you agree, we’ve reprinted them in the blog post Automated Export System (AES) Certification Statements.

- Emails: The Census Bureau, which has authority over the Automated Export System, sends out a lot of emails. This blog post—AESDirect Tips Direct from Census—summarizes some of their messages, such as clarification of their downtime policy and how you might get a rejected status even after an ITN has been issued.

- Data Elements: The blog post A Closer Look at Electronic Export Information (EEI), defines some of the more confusing data elements that are required for an AESDirect filing.

- License Codes: Exporters must include either a license or exemption code on all AES filings. The blog post Export License Number or Exemption Code Required for All AESDirect Filings, includes a chart of license types, their codes, a description and their licensing agency.

- Puerto Rico: While the blog post Is Your Shipment to Puerto Rico an Export? is not just about AESDirect, it does include helpful information on the AES data requirements when shipping to Puerto Rico.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article combines two previous articles that were first published in October and November 2016 and has been updated to include current information, links and formatting.