The October update of the WTO’s Global Trade Outlook and Statistics largely reaffirms the April forecast, pointing to a gradual recovery in merchandise trade despite widening regional conflicts and increasing policy uncertainty. However, at the regional level, we have seen weaker-than-expected European trade and stronger-than-expected Asian exports.

Since the last report, inflation has fallen, as expected, in advanced economies, prompting central banks to begin lowering interest rates. We expected these developments to boost consumption and investment, thereby increasing demand for imports. In particular, we projected that Asian economies would lead the trade recovery, while North America, Europe and other regions would contribute more modestly, yet positively.

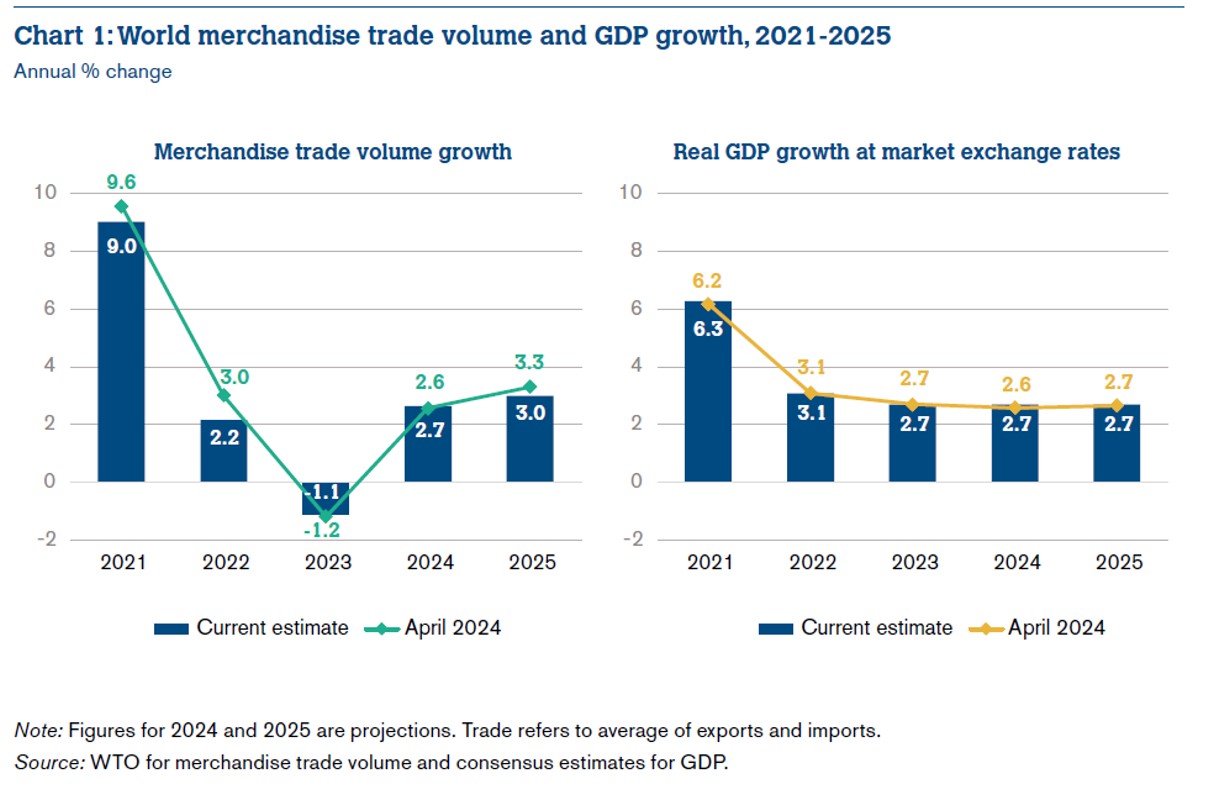

Broadly speaking, these expectations have materialized. As shown in Chart 1, we now anticipate a 2.7% increase in global merchandise trade volume in 2024, slightly up on our previous estimate of 2.6%. However, the forecast for 2025 has been revised downward, from 3.3% to 3.0%. Trade growth in 2024 and 2025 will likely be accompanied by real global GDP growth of 2.7% at market exchange rates, both this year and next.

While the overall figures for global trade and output have remained stable, notable shifts in regional trade growth are emerging. Downside risks to the forecast have also intensified, particularly with the escalation of the conflict in the Middle East, which could further disrupt trade flows.

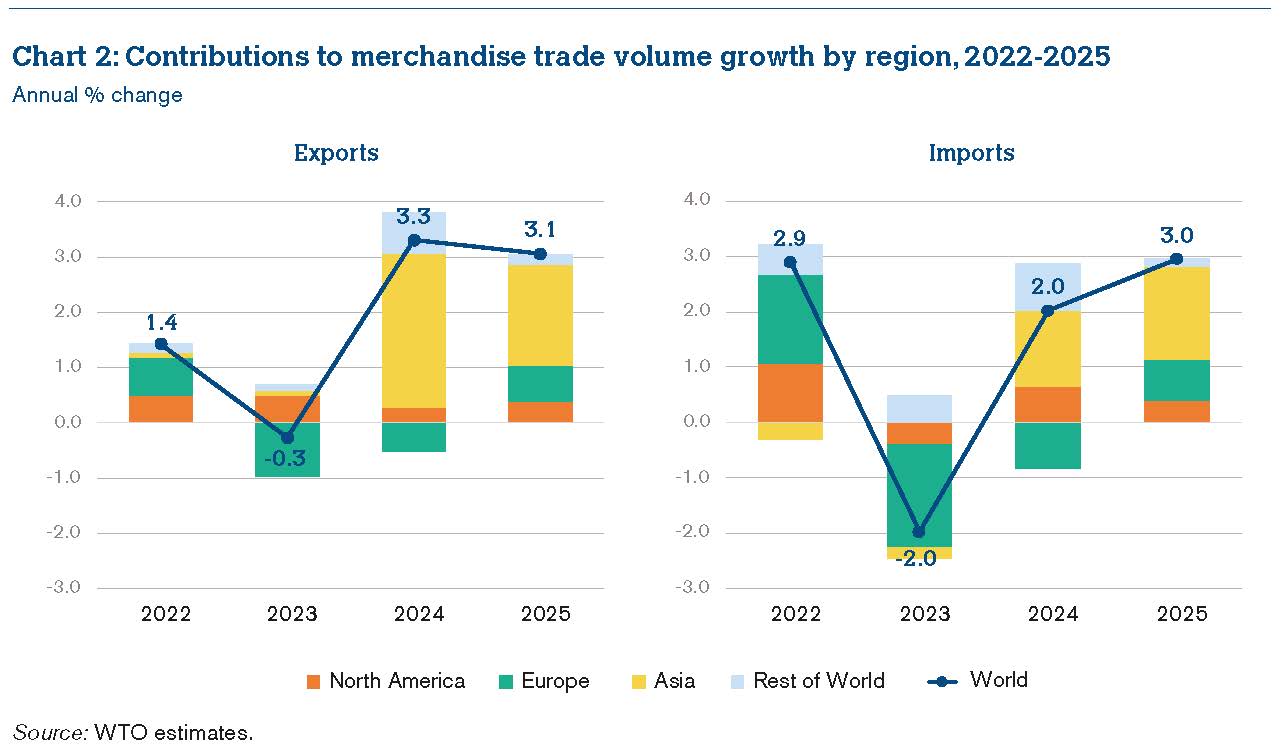

Two key differences stand out between the current forecast and the previous one. First, trade growth in European economies has been weaker than expected, affecting both imports and exports. Second, export growth in Asian economies has been stronger than expected.

As illustrated in Chart 2, Asia is expected to contribute more than any other region to global export growth in 2024, adding 2.8 percentage points to the projected 3.3% growth in exports. The region is also expected to contribute 1.4 percentage points to the 2.0% import growth foreseen for this year. Meanwhile, North America is expected to contribute 0.6 percentage points to import growth in 2024, partly offsetting Europe’s negative contribution of -0.8 percentage points. Regional trade contributions should stabilize in 2025, aligning more closely with medium-term trends.

The stronger-than-expected export performance in Asia has been driven by increased exports of electronics, automotive products and other manufactured goods from China, with other Asian economies such as India, Viet Nam and Singapore also reporting robust export growth. On the downside, Europe’s export decline has been led by a contraction in the automotive and chemicals sectors, both of which are concentrated in Germany.

The outlook for services trade remains more positive than for goods, with the value of global commercial services trade in US dollars rising 8% year-on-year in the first quarter of 2024. More comprehensive services data will be released later this month, but continued strong growth is anticipated for the second quarter.

Returning to merchandise trade, we are seeing increasing evidence of trade fragmentation driven by geopolitical concerns. Trade is increasingly conducted among like-minded economies, a trend accelerated by the war in Ukraine. However, we have yet to observe a broader shift towards regionalization or near-shoring on a global scale.

The full report is available here.

Reach us to explore global export and import deals