U.S. exports to new free trade agreement (FTA) partner countries have grown roughly three times as rapidly on average in the five years following the agreement’s entry into force as the global rate of growth for U.S. exports, according to U.S. Chamber of Commerce research. But despite the benefits, why do 70% of companies NOT fully take advantage of FTAs? Many point to the complexity of the qualification process.

U.S. exports to new free trade agreement (FTA) partner countries have grown roughly three times as rapidly on average in the five years following the agreement’s entry into force as the global rate of growth for U.S. exports, according to U.S. Chamber of Commerce research. But despite the benefits, why do 70% of companies NOT fully take advantage of FTAs? Many point to the complexity of the qualification process.

If you’re part of that overwhelming majority—and you’re paying higher duties and tariffs because of it—this article is for you (along with our free whitepaper on the topic: How to Qualify for a Free Trade Agreement). This is one in a series explaining the steps you need to take to determine if your goods qualify for preferential treatment under an FTA. Today we’ll explain the three primary ways goods can qualify for reduced tariffs under a free trade agreement.

3 Ways to Qualify for a Free Trade Agreement

Each FTA has specific guidelines, criteria and exceptions that dictate whether goods are eligible for preferential treatment, so you’ll need to check the specific rules of origin of the FTA you’re hoping to use. But you’ll find that there are typically three primary ways for goods to qualify:

1. The goods are wholly obtained or produced in one of the FTA countries.

According to the ITA: “A good is wholly obtained if produced entirely in the territory of one or more of the FTA countries as referenced in the FTA Rules of Origin Chapter. The purchase of a good in the territory does not necessarily render it wholly obtained or produced. This type of FTA qualification often applies to commodities. Some examples include corn from Iowa, coal mined in Wyoming, apples from Washington, fish from North American waters brought in by a U.S. fishing vessel, and even a moon rock retrieved by a U.S. astronaut.”

2. The goods are made up of all components and materials that originated in one of the FTA countries.

For a product to meet this requirement, every part, material or ingredient that goes into its production process must come from one of the countries participating in the FTA. Manufacturers and producers must solely source from FTA partners.

For example, say the U.S., country A, has a free trade agreement with countries B and C. You work in the apparel industry. Your garments can qualify for FTA benefits if all the fabrics, buttons, zippers, threads and other materials used in the manufacturing process are sourced from FTA countries. A t-shirt made in the U.S. can be considered FTA-eligible if the cotton used to make the fabric is grown in country B, the dye used for coloring is produced in country C, and the sewing threads and labels are manufactured in the U.S.

If your goods contain non-originating materials, but they are below a certain de minimis threshold, they may still qualify for preferential treatment. In general, the de minimis rule allows up to 10% of adjusted value. But each FTA has exceptions to the de minimis rule (e.g., for agricultural or textile shipments), and some have different thresholds, so if using de minimis rules to claim your good is originating, make sure you consult the specific FTA you’re using first.

(These first ways of determining eligibility are the most straightforward. If they don’t apply to your product, you’ll need to dive deeper into the rules of origin.)

3. The goods meet other product-specific requirements, laid out in the FTA’s rules of origin.

This is how goods made up of components coming from outside the FTA region can qualify for preferential treatment. Within the rules of origin, there are typically two more ways to qualify:

Tariff Shift Method

This is the most frequently used method. Tariff shift means that product components are transformed enough to result in a new HS classification code for the finished product. The amount of non-FTA components does not matter. The ITA uses this example:

Wood is manufactured into a piece of furniture. The HS codes for the wood and for the piece of furniture differ enough to qualify the finished product under the FTA rules of origin.

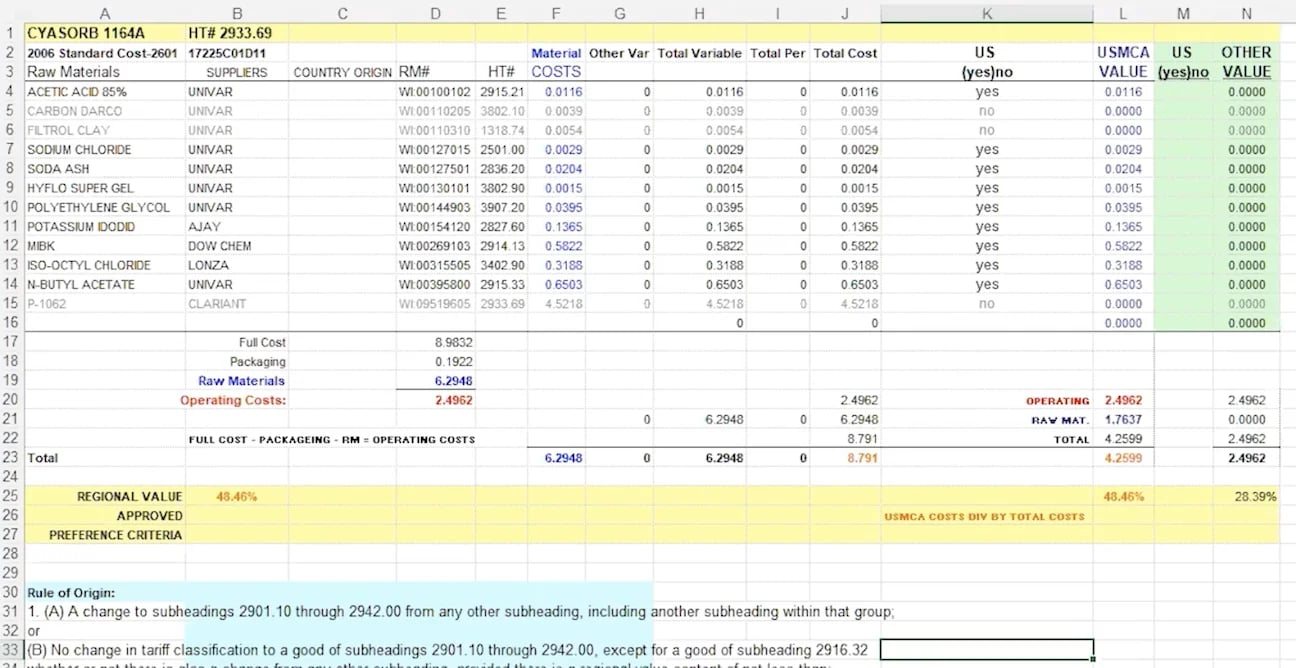

The USMCA and Other Free Trade Agreements and Ask Me Anything: The USMCA and Other Free Trade Agreements, during which our speaker, Robert P. Imbriani, explained how he uses the following spreadsheet to calculate the RVC of a product.

The USMCA and Other Free Trade Agreements and Ask Me Anything: The USMCA and Other Free Trade Agreements, during which our speaker, Robert P. Imbriani, explained how he uses the following spreadsheet to calculate the RVC of a product.

Some of the information you’ll want to include in a worksheet:

- Name of the finished product and the first six digits of its HS number.

- List of the raw materials included in the product.

- HS number of each of the raw materials—so you can easily see if an appropriate tariff shift occurred.

- Cost of each material used to make a specified unit of the product.

- Whether the materials are originating or not.

- The rules of origin you will be following.

After adding your information to a worksheet like this one, you will then need to be concerned with the materials that are not originating. Do they go through an appropriate tariff shift? If not, is their percentage of the total finished product within the levels deemed acceptable by the FTA’s rules of origin?

If you need help creating a similar worksheet for your products, you can download a blank version of the example above (Excel download) to help you get started. Tailor it to your needs, based on the FTA you’re using and the contents of your product.

Understand the Rules to Receive FTA Benefits

The decision to claim preferential treatment demands a thorough understanding of the rules governing each FTA. For a deeper dive into the intricacies of leveraging FTAs for your business, download our comprehensive whitepaper, How to Qualify for a Free Trade Agreement (FTA).

Like what you read? Join thousands of exporters and importers who subscribe to Passages: The International Trade Blog. You’ll get the latest news and tips for exporters and importers delivered right to your inbox.