If your business is involved in international trade and looking for a competitive edge, you cannot ignore free trade agreements (FTAs). Understanding and leveraging FTAs can improve your bottom line and open up market access. This article is one in a series explaining the steps you need to take to determine if your goods qualify for preferential treatment under an FTA. Today we’ll look at how to determine the tariff rate for your goods by using the U.S. Harmonized Tariff Schedule. Tariff rates significantly impact the cost and competitiveness of goods and are one of the primary reasons to qualify your goods under an FTA.

If your business is involved in international trade and looking for a competitive edge, you cannot ignore free trade agreements (FTAs). Understanding and leveraging FTAs can improve your bottom line and open up market access. This article is one in a series explaining the steps you need to take to determine if your goods qualify for preferential treatment under an FTA. Today we’ll look at how to determine the tariff rate for your goods by using the U.S. Harmonized Tariff Schedule. Tariff rates significantly impact the cost and competitiveness of goods and are one of the primary reasons to qualify your goods under an FTA.

The following information is part of our complete whitepaper on the topic, How to Qualify for a Free Trade Agreement (FTA).

Properly Classify Your Product with the Correct HS Code

Accurate classification of your products under the Harmonized System (HS) is the first step to determining the tariff rate for your goods. Each product in international trade is assigned a unique HS code, which is used by customs authorities around the world to identify the duty and tax rates for specific types of products.

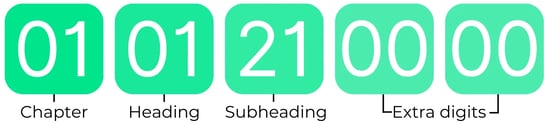

The HS classification is a six-digit standard, called a subheading. While these numbers are uniform across the globe, many governments add additional digits to the HS number to further distinguish products in certain categories. These additional digits are typically different in every country.

The HS classification is a six-digit standard, called a subheading. While these numbers are uniform across the globe, many governments add additional digits to the HS number to further distinguish products in certain categories. These additional digits are typically different in every country.

Different FTAs may have specific criteria for particular HS codes, making it imperative to accurately determine the code for your product. Incorrect classification can result in denied preferential treatment or, worse, legal repercussions.

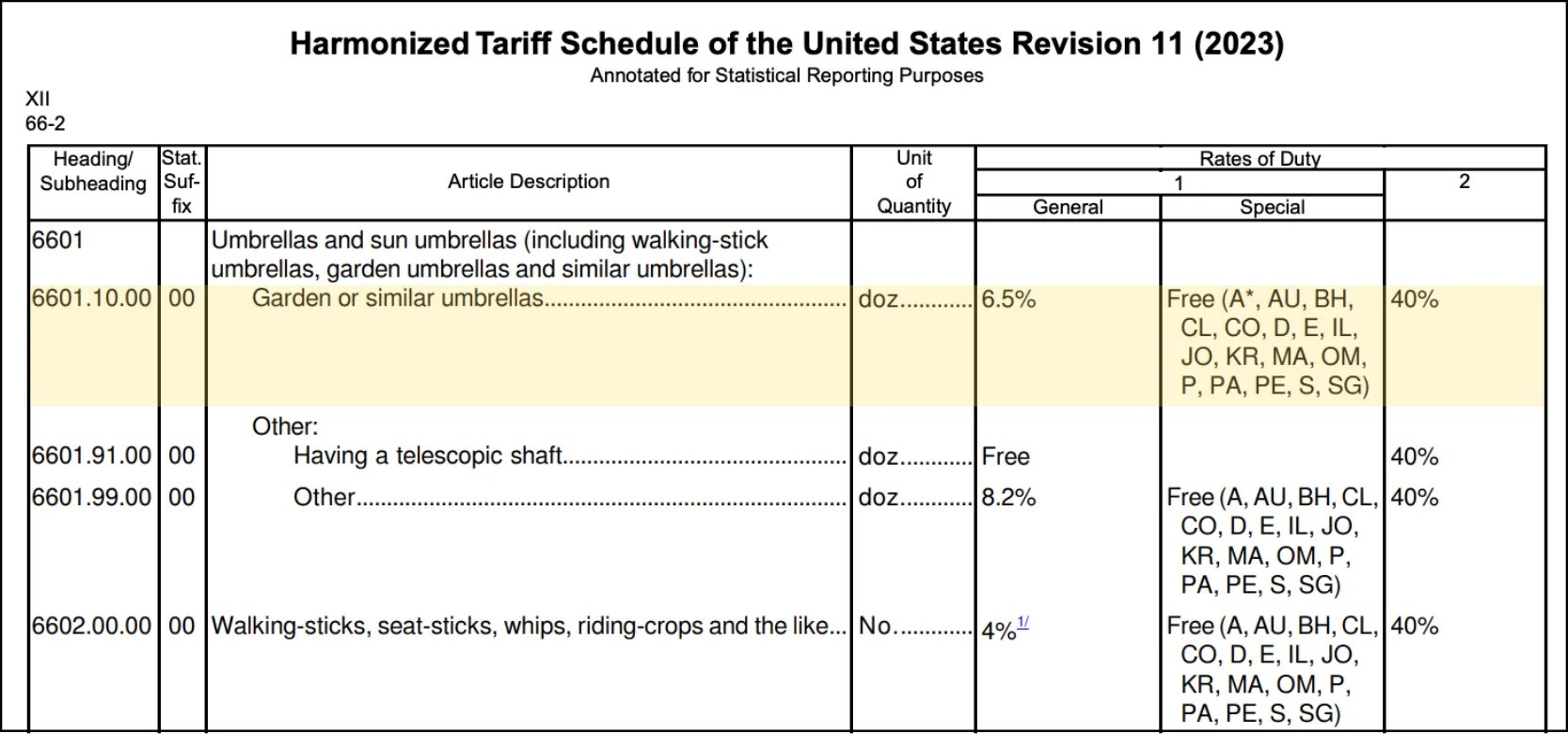

Click here to try the Product Classification Wizard for free. Once you’ve found the correct classification, you can determine the applicable tariff rate for your product under an FTA by using the U.S. Harmonized Tariff Schedule. Let’s look at an example for “garden or similar umbrellas:” 6601.10.0000. Here’s what the HTS shows us about those products: Duty rates for trade with countries with which the U.S. has Normal Trade Relations (NTR) are listed in Column 1 under general. In this case, it would be 6.5% for garden umbrellas. Duty rates for countries not covered by NTR are listed in Column 2, a tariff rate of 40% in this case —significantly higher to discourage trade with certain countries. (At the time of publication, Cuba, North Korea, Russia and Belarus were Column 2 countries.) The duty rate for goods that qualify under an FTA is found in Column 1 under special. In this case, this product is duty-free for the agreements listed. Landed cost refers to the total cost of a product once it has been shipped and arrived at its destination, including the cost of the product itself, transportation fees, customs duties, taxes and any other charges incurred during the shipping process. It is a critical factor to consider when evaluating the costs and benefits of FTAs. You should calculate the landed cost of the product under the FTA versus the non-FTA scenario. This calculation can help companies understand the true cost savings of an FTA. Use the Shipping Solutions Landed Cost Calculator to accurately estimate this cost. In a globalized marketplace, FTAs are one important tool available to businesses looking to expand and stay competitive. The benefits—tariff elimination and increased market access, among others—can help propel companies to new heights. However, do remember that participation in FTAs is voluntary, and the decision to claim preferential treatment should only be made if you’re certain you can adhere to the rules of the FTA. Like what you read? Join thousands of exporters and importers and subscribe to the International Trade Blog to get the latest news and tips delivered to your inbox.  You can search on a partial HS number, you can search on words or phrases that describe your product or you can look at the entire tree of HS codes and drill down to specific numbers.

You can search on a partial HS number, you can search on words or phrases that describe your product or you can look at the entire tree of HS codes and drill down to specific numbers.

How to Find Free Trade Agreement (FTA) Tariff Rates

Using Landed Cost to Measure FTA Savings

Understand the Rules to Receive FTA Benefits