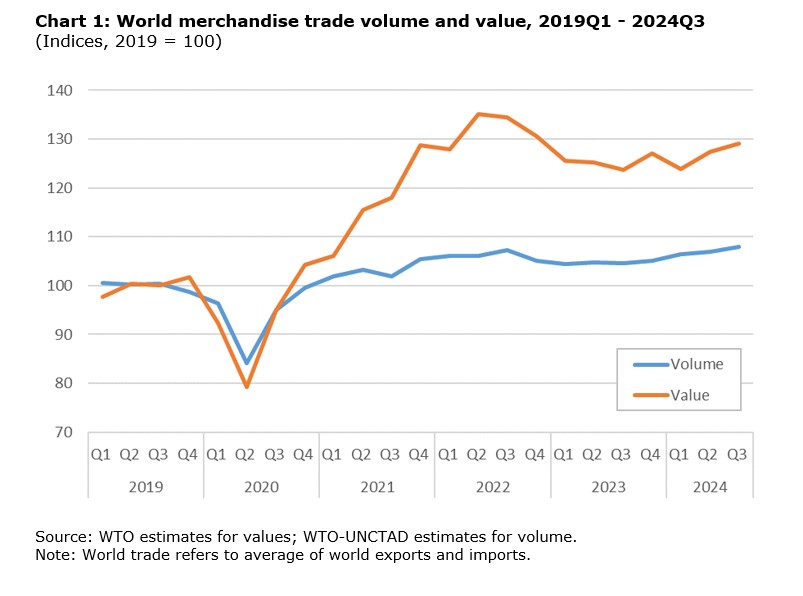

By comparison, merchandise trade in current US dollar terms was up 4.3% year-on-year in Q3. This represents a significant improvement from the 1.8% increase seen in Q2 and the 1.4% contraction observed in Q1.

For the year through September, trade volume was up 2.4% compared to the same period in 2023, slightly less than the WTO’s most recent forecast of 2.7% for 2024 issued on 10 October. Meanwhile, the value of merchandise trade was up 1.6% over 2023. Slower trade growth in value terms than in volume terms implies a small (less than 1%) decline in prices of traded goods during this period.

The projected 2.7% increase in the volume of world merchandise trade in 2024 is attainable if quarter-on-quarter growth in Q4 continues at around the same rate as in Q3. This is quite likely since the most recent WTO Goods Trade Barometer of 9 December signalled continued trade expansion through the end of the year. However, the short-term outlook for trade is clouded by rising global trade tensions.

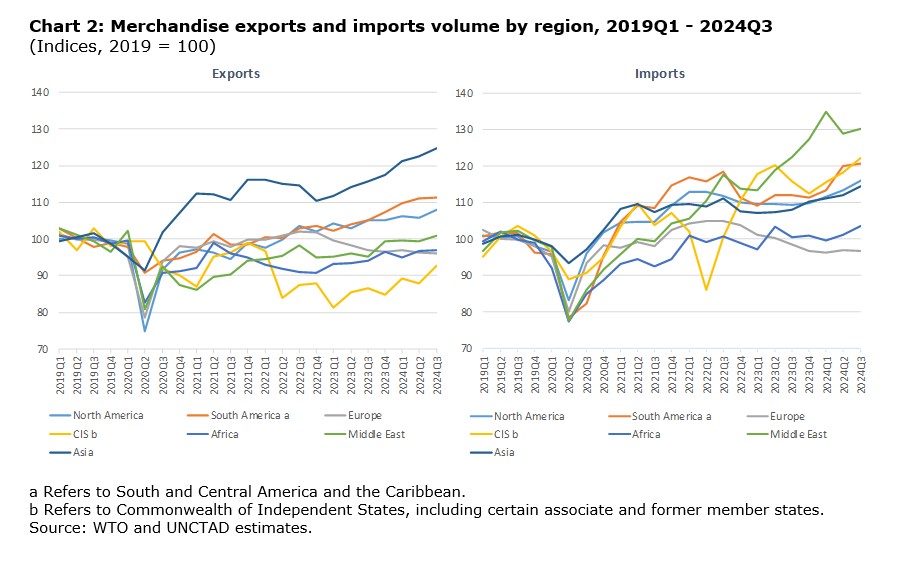

Regional trade volume performance

In the third quarter of 2024, quarterly merchandise trade volume growth was positive in most regions, with the important exception of Europe (see Chart 2).

The Commonwealth of Independent States, including certain associate and former member states, recorded the largest quarter-on-quarter increase in exports at 5.4%. North America followed with a 2.1% rise, while Asia and the Middle East respectively posted gains of 1.6% and 1.5%. South and Central America and the Caribbean saw modest export growth of 0.2%, while shipments from Africa only grew a fraction of a percent (0.1%).

The CIS region also led on the import side with a 3.3% quarter-on-quarter rise in Q3, followed by Africa at 2.5% and North America at 2.3%. Asia recorded a 2.0% increase, while the Middle East posted a 1.0% gain. South and Central America saw its imports grow just 0.6% in the latest quarter.

Europe was the only region to record negative export and import volume growth, ‑0.2% and ‑0.3% respectively, as manufacturing continued to experience a prolonged downturn.

Europe’s trade performance in the first three quarters of 2024 was slightly worse than the WTO’s October forecast for 2024. The region’s exports during this period were down 1.8% year-on-year, while imports fell 3.3%. These contractions were slightly worse than the projected declines of 1.4% for exports and 2.3% for imports for the year.

Trade in value terms

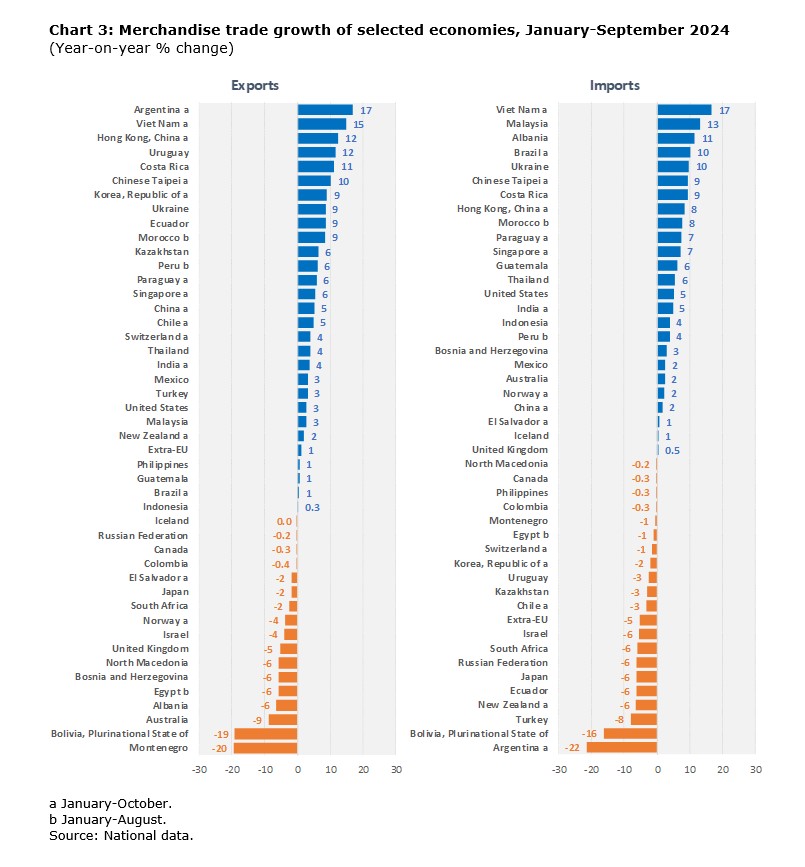

Latest figures in value terms through September show robust growth in most Asian and Latin American economies, with some notable exceptions (see Chart 3).

The strongest export performance was recorded by Argentina, which saw a 17% surge in goods shipments despite uncertainty related to its economic reforms. Viet Nam also stood out for the strength of its exports, which were up 15% compared to the same period in 2023. Other large economies saw more modest increases, including China (5%) and the United States (3%). Extra-EU exports were up just 1% year-on-year while exports were down in Japan (-2%) and the United Kingdom (-5%).

Viet Nam had the strongest import growth, with a 17% year-on-year increase, balancing its strong export performance. Other Asian economies saw imports rise sharply, including Malaysia (13%), Chinese Taipei (9%), and Singapore (7%). The United States saw a 5% rise in imports, while China’s imports were only up 2%. By contrast, extra-EU imports fell 5%, while those of Japan dropped 6%. Among other reporting economies, Argentina saw the sharpest decline in imports, which plunged 22% amidst a continuing economic crisis.

Quarterly and monthly statistics presented above are estimates as of time of publication and subject to frequent revisions. They are available for download at WTO Stats. Additional annual trade data and visualizations can be accessed at WTO | World Trade Statistics 2023.

Share

Reach us to explore global export and import deals