Each sectoral profile includes sections on which industries and regions contribute inputs for exports of the featured sector, the share of domestic and foreign content, the top and growing economies contributing inputs to the sector, and key trends in GVC participation.

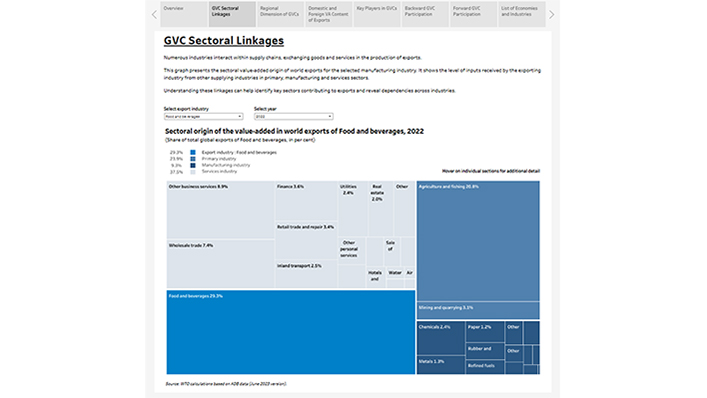

The Food and Beverages Sectoral Profile highlights that besides the value-added contribution of the agro-industry itself (29%) into global food and beverage exports, other industries such as agriculture (21%), services (38%) and other manufacturing (9%) are also vital for the sector. The profile further notes that most food supply chains operate within regions. In 2022, 85% of the food and beverage exports from North America were produced there. Asia had 76% of its exports made within the region, while Europe had 62%, showing European businesses have stronger connections with global markets.

“During the COVID-19 crisis, food supply chains were among the most resilient from the manufacturing sector. They are impacted by the war in Ukraine and its repercussions on energy and food prices, grain shortages and deteriorated access to staple cereals and fertilizers,” the profile states. “Global food security as well as sustainability issues are legitimate policy objectives at the heart of WTO activities and negotiations.”

The Textiles and Clothing Sectoral Profile notes similarities in the value-added patterns of China and India — the sector’s largest players — with the domestic content of their exports amounting to 89% and 83% respectively in 2022. In contrast, several South-East Asian economies sourced a high share of their value-added exports from foreign suppliers, notably Viet Nam (64% foreign value-added in its total exports of textiles and clothing), Cambodia (58%) and Indonesia (49%).

“In 2005, the WTO Agreement on Textiles and Clothing, which succeeded the Multi-Fibre Arrangement, expired, bringing to an end a trade regime based on trade quotas and restrictions for exports from developing economies. This helped to integrate developing economies into textiles and clothing supply chains, with countries profiting from their comparative advantages in terms of raw materials, workforce and technical expertise,” the profile states.

More GVC Sectoral Profiles will be released in the coming months. The user guide is available here.

The profiles are furthermore complemented by the new GVC Dashboard, which represents the online version of the graphs shown in the GVC Sectoral Profiles with full coverage of economies and industries from the data source.

The profiles present WTO calculations based on estimates from the Asian Development Bank (ADB) Multi-Regional Input-Output (MRIO) tables (June 2023 version). MRIO tables cover trade in goods and services and were available, at the time of production, up until 2022 for a set of 72 economies and 35 sectors. The latter are classified according to the International Standard Industrial Classification (ISIC), Revision 3.1.

Share

Reach us to explore global export and import deals