Africa’s exports of IGs amounted to US$ 265 billion in 2021, growing an average of 15% yearly from 2019 to 2021 according to the information note. IGs refer to inputs (excluding fuels for the purposes of this note) used to produce a final product and are an indicator of the activity in supply chains. Africa’s IG exports represented three-quarters of its total merchandise exports in 2021. The region’s imports of intermediate goods, meanwhile, was worth US$ 284 billion, with annual average growth of 5% for 2019 to 2021. These growth rates are higher than the 5% and 2% average increases for IG exports and imports respectively for 2010-2021.

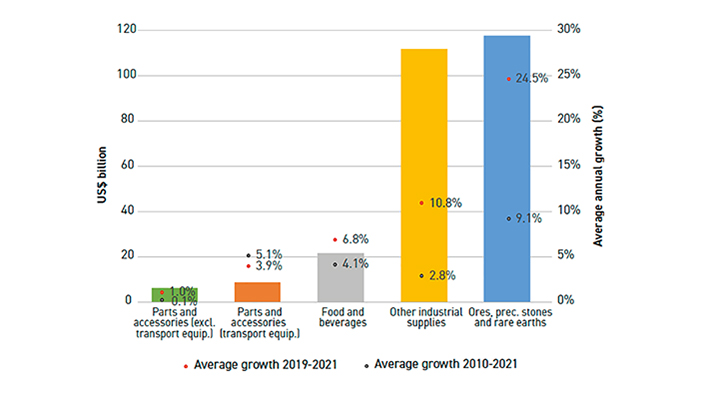

The surge in IG exports was mainly driven by the supply of mostly raw or semi-processed ores, minerals, metals and agricultural products, which saw higher prices on global commodity markets in the aftermath of the COVID-19 pandemic. The majority of Africa’s IG imports, in contrast, was for industrial supplies (62% share of total IG imports) while food and beverages accounted for 15%. The exchanges of industrial inputs between China and Africa grew at a fast pace between 2010 and 2021, averaging annual growth of 10%.

The information note also highlights that the region’s IG exports are concentrated among just a few economies, led by South Africa which accounts for 30.9% of the region’s total IG exports, and a relatively small range of products. Moreover, the share of intra-African trade in total IG exports, a proxy for trade in regional supply chains, was estimated at 13% in 2021. This may be an under-estimate due to a paucity of reported data and the partial or non-coverage of informal trade in official statistics, which is significant in the region.

The full information note is available here.

Share

Reach us to explore global export and import deals