Do you need help understanding which tariffs apply to your imported goods? Shipping Solutions Import Controls Software provides a detailed review of the tariffs that apply to your goods, and when paired with our Product Classification Software, it can make you a tariff expert in no time!

Do you need help understanding which tariffs apply to your imported goods? Shipping Solutions Import Controls Software provides a detailed review of the tariffs that apply to your goods, and when paired with our Product Classification Software, it can make you a tariff expert in no time!

In the news we hear a lot about tariffs, which are taxes on imported goods. A duty is a broader term that includes tariffs and any other taxes, but in this article the words duty and tariff are used interchangeably.

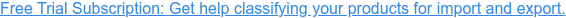

Calculating the correct tariff/duty starts with identifying the right Harmonized Tariff System (HTS) number for your product. Our Product Classification Software simplifies the process. You can search for the HTS code by entering the first few digits of the 10-digit code or by entering a short description of the goods. In either case, you then review the results to find the code that best fits your products’ specifications.

In the following screenshot, I have used the Product Classification Software to find the code for some semiconductor devices. I can see the default duty is 0%—which might indicate that the good can be imported into the U.S. duty free. However, the results also display additional Chapter 99 codes (e.g. 9903.45.25) that may pertain to my item. Chapter 99 is the section of the U.S. HTS codes that includes additional import restrictions such as the Section 301, Section 232, IEEPA and reciprocal tariffs that are currently in the news and that have been dramatically increasing import tariff rates.

The screenshot shows 12 additional Chapter 99 tariffs that may apply to my product depending on the source and material composition of my goods. That’s a lot of codes to look up, so now I’m going to use the Shipping Solutions Import Controls Software to identify which of those codes and their corresponding tariffs pertain to my item.

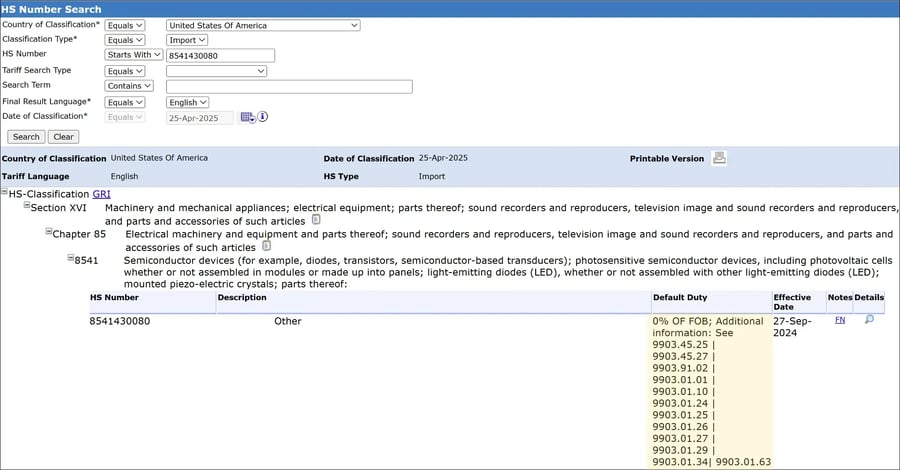

As an example, I’ll look at an import into the United States from China. I’ll use the item’s HTS number that we identified above, 8541.43.0080, and enter it into the Import Controls Software. If you have a subscription to both Product Classification and Import Controls software, you can look up a code from within the Import Controls software by simply clicking the magnifying glass.

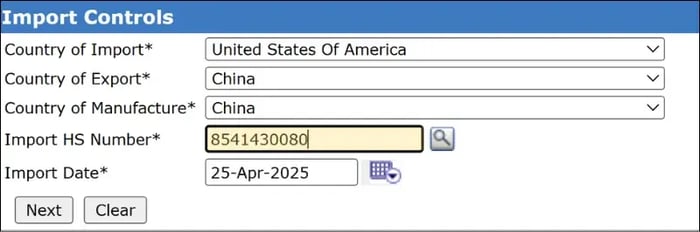

When I click “Next” the results look like this:

The “Prohibition” control type shows that controls may apply, and the “Other Controls” control type shows that controls do apply. I can scroll down to get more detail:

The “Prohibitions” detail shows that the item can’t be imported if it was made in the Xinjiang Uyghur Autonomous Region of China because of the Uyghur Forced Labor Prevention Act. This act has been in force since 2021. If my item was not made in this region of China, then this control would not apply.

If I keep scrolling I can get more detail on the “Other Controls” that apply to my product, which include additional tariffs:

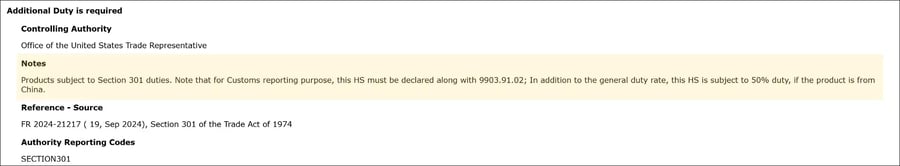

In the screenshot above, I see that my item is also subject to an additional 50% tariff on imports from China under Section 301 of the Trade Act of 1974, and I am instructed to declare the HTS code 9903.91.02 in addition to the original HTS code of 8541.43.0080.

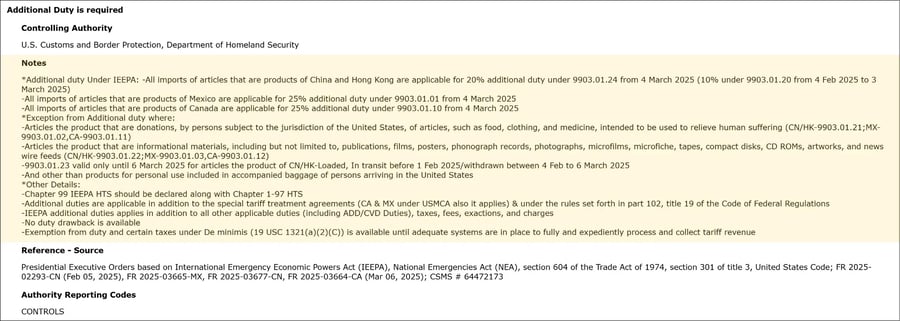

Scrolling further I see in the screenshot below that there is also an additional 20% tariff under the International Economic Powers Enhancement Act (IEEPA), that went into effect on March 4, 2025, and I must report the HTS number 9903.01.24 in addition to the original HTS code of 8541.43.0080 and the one identified above, 9903.91.02. There are also some exceptions listed in the screenshot below, such as products that are donations.

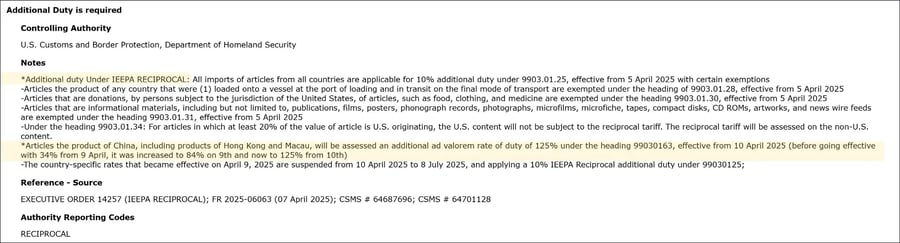

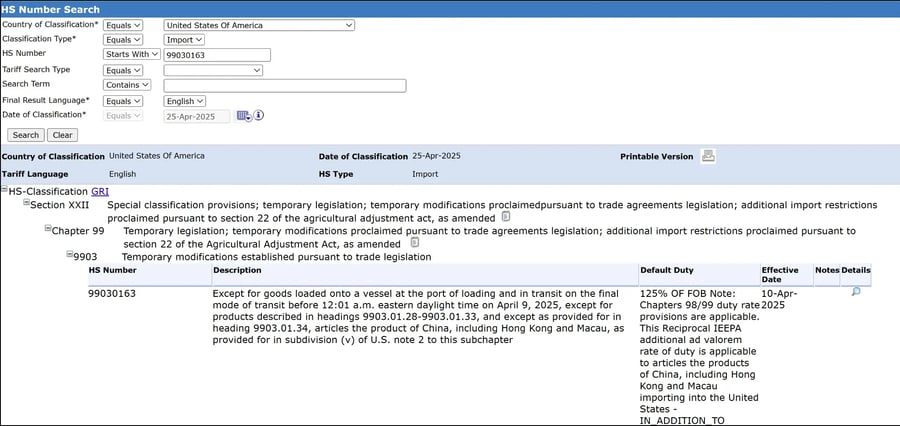

If I keep scrolling down the Import Controls Software results page, I see another CBP tariff called IEEPA Reciprocal, shown below. This tariff shows an additional duty for items from China of 125% under heading 9903.01.63.

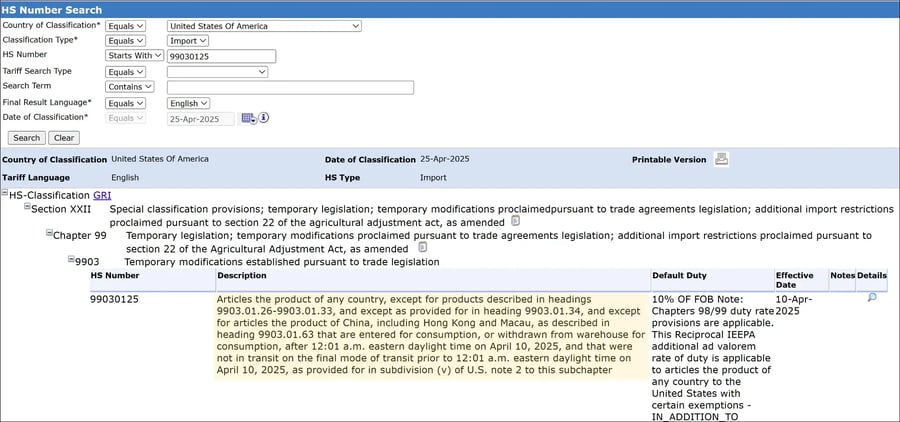

You might think that the 10% additional tariff under 9903.01.25 would apply, but I looked up that code in the Product Classification Software, and you can see in the screenshot below that there is an exception if the item falls under 9903.01.63, which this item would because it is being imported from China.

And here are the results for HTS code 9903.01.63:

To summarize, this good is subject to Section 301, IEEPA and IEEPA Reciprocal tariffs when it’s imported from China. In addition, this same item may be subject to additional tariffs under Section 201 of the Trade Act of 1974, depending on its particular specifications. As you can see, to get the exact duty rate you need to have knowledge of the item you are importing and compare it to all the potential duties and exceptions.

When used together, the Shipping Solutions Product Classification and Import Controls software can help you navigate these uncertain times in international trade. Let Shipping Solutions software properly determine your products’ duty rates—register here for a free trial subscription.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.