Customs and Border Protection (CBP) investigates allegations of dumping or unfair foreign subsidies, but they also have the authority to investigate potential violations of any imposed Anti-Dumping or Countervailing Duties (AD/CVD) under the Enforce and Protect Act (EAPA) of 2015.

Customs describes EAPA as a “multi-party, transparent, administrative proceeding where parties can both participate in and learn the outcome of the investigation. It also maintains due process for parties to the investigation by providing an option for them to request administrative and judicial reviews of CBP’s determination as to evasion.” Self-assertions of transparency and due process aside, many have found EAPA cases to be highly secretive and not always fair.

Frequently, an EAPA case involves an allegation that Chinese goods are allegedly transshipped through another country (or only subject to minor processing) to avoid paying AD/CVD duties. Since AD/CVD duties are applicable based upon the commodities country of origin, nefarious companies can ship goods from China to for example, Vietnam, India, Mexico, Taiwan, Malaysia, or some other country, and claim that these goods do not originate from China after all. Importers, in good faith, will declare that their imports are not subject to AD/CVD duties because they are not aware of the true origin of the goods. Such importers might not be liable for penalties if their belief was in good faith and based on facts, but such importers would still be subject to massive duties. Thus, contrary to popular option, good/honest importers may also find themselves the recipient of a “Notice of Investigation and Interim Measures” from Customs and potentially subject to massive duties.

EAPA Cases & Transparency

Since 2016, Customs has opened over 200 EAPA cases. The outcomes have been a bit one-sided. In all but ten of those cases, Customs has gone on to determine that there was, in fact, evasion of duties. Subsequent requests for administrative review almost always uphold the original decision. Of the thirteen reviews done in 2023, for instance, eleven were “Affirmed,” one was “Reversed,” and one was “Partially Affirmed and Partially Reversed.”

The Exception: Royal Brush

In 2018, Royal Brush, a pencil manufacturer, was accused of transshipping

Chinese-made pencils through the Philippines, repackaging them as “made in the Philippines” in the process. CBP commenced an investigation and later issued a final affirmative determination of evasion. Royal Brush asked for an administrative review. CBP’s Office of Trade, Regulations, and Rulings affirmed the evasion determination.

Royal Brush, however, felt that they were denied due process. CBP took photographs on-site and collected other information such as facility production capability and information about certain invoices and purchase orders. CBP did not provide any of this information to Royal Brush, and instead only provided them with the public, redacted version of the report.

Customs hid behind the fact that the evidence collected was “confidential business information” which they do not disclose in public notices. But, Royal Brush sought judicial review (first at the CIT) and then in July of 2023, U.S. Court of Appeals for the Federal Circuit did not agree, finding that due process “includes the right to know what evidence is being used against one.” The Court also stated that confidential business information is not exempt from the constitutional requirement of disclosures to parties in administrative proceedings brought against them.

As much as it might appear that this case is a bellwether for a more transparent EAPA process, so far it hasn’t amounted to much in Customs rulings. Many of the cases that have gone up for administrative review in the months since have cited the Royal Brush ruling, alleging that their case also unfairly used confidential information against them. Customs, however, has dismissed those arguments, noting that the Royal Brush decision only requires them to disclose the information used in their determination, not all the information they acquired in the course of their investigation. It remains to be seen where that line might be drawn if further appeals are made.

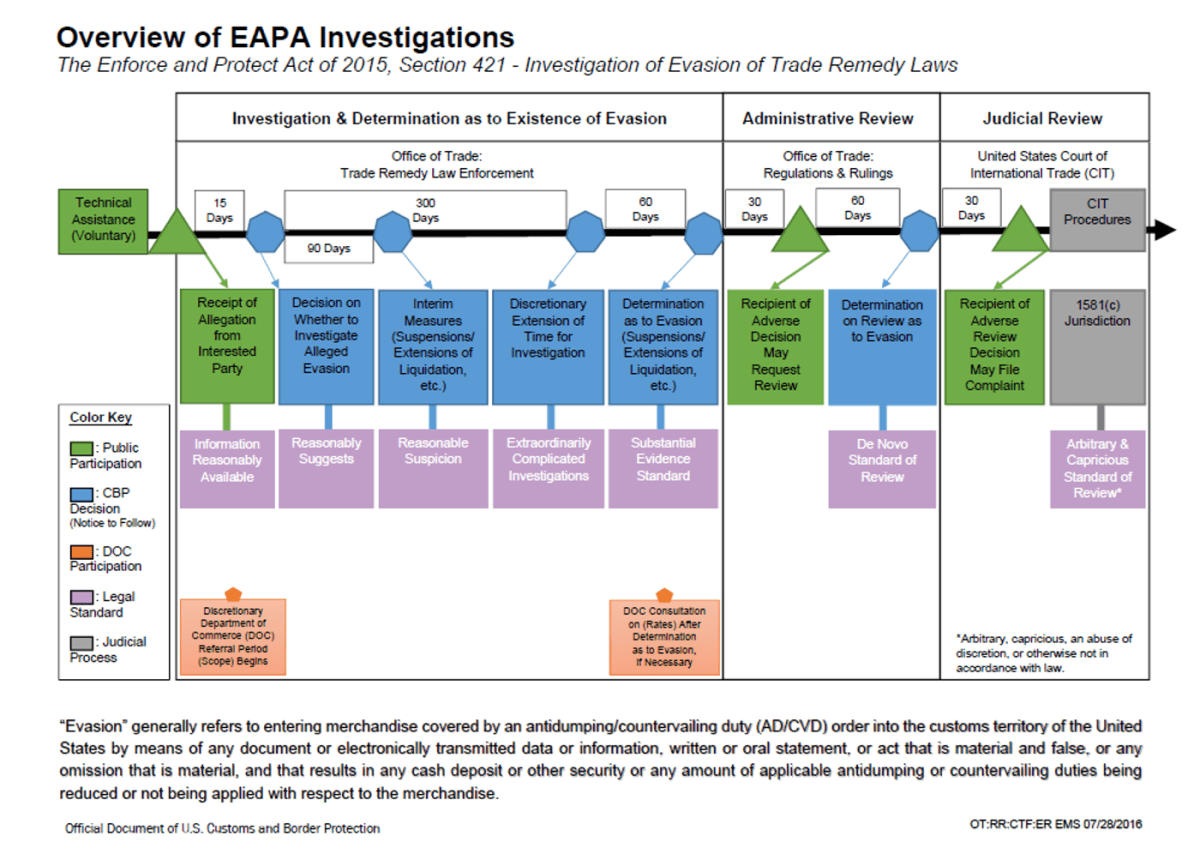

A full overview of the EAPA investigations timeline including where administrative and judicial review takes place can be found here:

It Wasn’t Me!

What if you were unaware that one of your suppliers was engaged in transshipping goods to avoid AV/CVD duties or any other type of evasion? Well, according to the law, too bad. 19 U.S. Code § 1517 defines evasion without regard to whether or not the importer had any knowledge of the practice. “Evasion” is defined as “entering covered merchandise into the customs territory of the United States by means of any document or electronically transmitted data or information, written or oral statement, or act that is material and false, or any omission that is material, and that results in any cash deposit or other security or any amount of applicable antidumping or countervailing duties being reduced or not being applied with respect to the merchandise.”

In final determinations of evasion, Customs has pointed to how this definition gives no regard for an importer’s knowledge, though being an unwitting party may be an important consideration in any mitigation of penalties.

You are Guilty of Evasion . . . Unless you can Prove Otherwise

Complying with an EAPA investigation is critical to a successful outcome. EAPA cases run on a strict timeline, and if you fail to provide Customs with precise answers backed by evidence in a timely manner, Customs will apply “adverse inference”, meaning they will assume information that you fail to provide would negatively affect your case. In fact, Customs only has 15 days to decide whether or not they will open an investigation after an allegation is made.

As a result, investigations often start in a somewhat speculative manner. To respond effectively, your business needs to provide complete and timely answers to Customs during an EAPA investigation, and that means already having a system in place for gathering and maintaining adequate records.

Businesses found to have evaded AD/CVD duties often fail to provide sufficient evidence to support their claims, simply because they do not have this documentation. An experienced Customs Attorney can help your business get ahead of any potential AD/CVD duties or EAPA allegations. This is especially important if you source products from abroad at a price that gets the attention of your competitors.

A Customs Attorney Can Help your Business Navigate and Avoid EAPA Cases

Diaz Trade Law has significant experience in a broad range of import compliance matters, including defending EAPA allegations. Contact us at info@diaztradelaw.com or call us at 305-456-3830.

More information on EAPA: