The past year has been eventful for international trade. So, how did it perform in 2022? And what can we expect for 2023 and 2024? Today, the WTO is issuing a new report — the Global Trade Outlook and Statistics — that tackles those very questions.

Our analysis in this new report delivers two main findings:

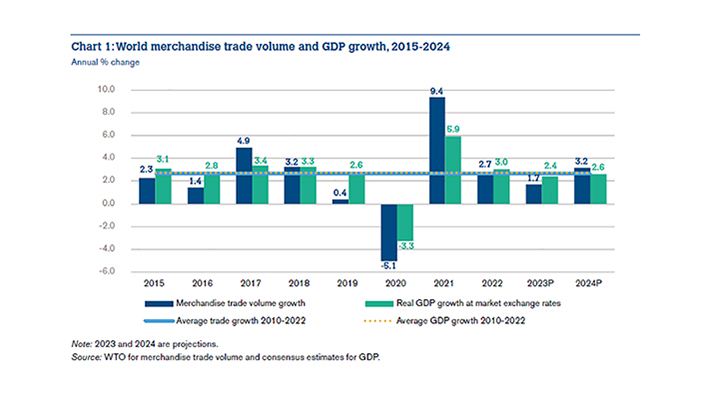

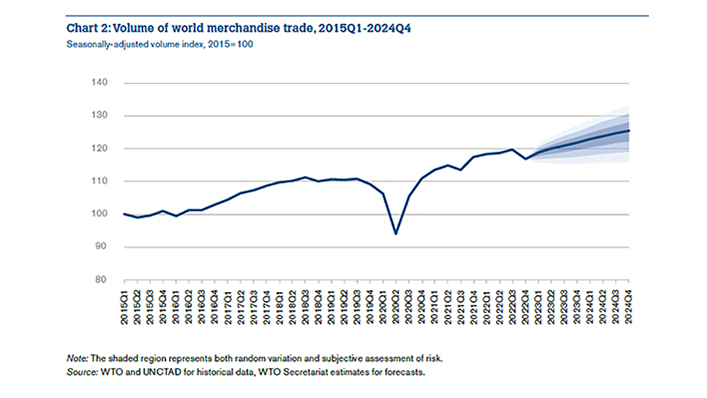

- First, goods trade was remarkably resilient for most of 2022 despite a challenging macro environment. During the first three quarters of 2022, year-on-year trade volume growth averaged 4.3 per cent, but an abrupt decline in the fourth quarter brought growth for the year down to 2.7 per cent.

- Second, the outlook for the global economy has slightly improved since our last forecast in October 2022, but the pace of trade expansion in 2023 is still expected to be subpar compared to previous years. We are now projecting a merchandise trade volume growth of 1.7 per cent in 2023, compared to last October’s prediction of a 1.0 per cent increase.

The global situation in 2022

The start of the war in Ukraine in late February 2022 delivered another blow to a global economy still reeling from the after-effects of the COVID-19 pandemic. Actual or threatened reductions in supplies of essential goods from Ukraine and Russia, particularly grains and energy products, caused commodity prices to spike and forced importers to scramble to find alternative sources for these goods. These spikes exacerbated inflation, which was already rising globally as a result of supply chain disruptions and the extraordinarily expansionary monetary and fiscal policies adopted during the pandemic.

Interest rate hikes by central banks did not immediately succeed in dampening growth and inflation, but by the end of 2022 their impact was starting to be felt, as commodity prices receded and GDP growth slowed.

Fresh outbreaks of COVID-19 in China also weighed on trade in the fourth quarter of 2022, although a relaxation of border controls on people and goods promises to provide a boost to the global economy going forward.

Taking all of these factors into account, year-on-year trade volume growth during the first three quarters of 2022 was stronger than expected, at 4.3 per cent. In particular, trade proved to be remarkably resilient to the war in Ukraine — an observation we discussed in detail in February.

However, this strong initial performance was followed by an abrupt decline in the fourth quarter of 2022, which dragged growth for the year down to 2.7 per cent. Several factors contributed to this trade slump, including rising COVID-19 infections in China and monetary tightening globally throughout the year. While this growth rate was weaker than the forecast of 3.5 per cent we made last October, it was quite close to our initial estimate of 3.0 per cent, made last April.

The trade outlook for 2023 and 2024

Turning to the current year, we estimate that merchandise trade volume growth will slow to 1.7 per cent in 2023, as global GDP growth slips to 2.4 per cent from 3.0 per cent last year. Trade growth of 1.7 per cent is slow by historical standards — for example, it is below the 2.6 per cent average rate since 2010 – but it does represent a modest upgrade compared to our forecast of 1.0 per cent from last October.

There are several reasons for the upward revision, most importantly an improvement in the consensus outlook for global GDP growth. We are now expecting a real GDP growth at market exchange rates of 2.4 per cent in 2023, which is a slight upward revision from our earlier estimate of 2.3 per cent. Falling commodity prices have also eased the squeeze on households and encouraged consumer spending in early 2023.

Our projections for 2024 show trade and GDP growth returning to more normal ranges, with trade growth potentially rising to 3.2 per cent, but we must remain cautious about these projections, given the many ongoing uncertainties surrounding monetary policy, financial market volatility and geopolitical tensions.

Particular risks that could negatively affect this forecast include the vulnerabilities revealed in the banking sector of late. The impact of recent bank failures in the United States and Europe mostly appears to have been contained, but a rapid rise in interest rates is bound to create strains in financial markets that could weigh on trade.

However, there is also some potential for optimism, resulting from the relaxation of COVID-19 restrictions in China. This could have particular benefits for services such as travel and transport.

Reach us to explore global export and import deals